5 Tips to Manage Your Cash Flow

Tips to manage and improve your firm's cash flow during a difficult period with automated billing, ePayment, expanding your services, etc.

Steven Burns, FAIA, shares his advice on why cash flow projection is important for your firm along with tips that makes managing cash flow easier.

Before we talk about cash flow projection, let’s start with a definition of cash flow. Many people mistake this for simply the cash flowing into the business. In actuality, cash flow is the net amount of cash that is being transferred in and out of the business every month. It is subtly different than profit in that cash flow actually measures the business's ability to generate cash.

While it’s important to understand your firm's profit margin as it indicates if the business model is sustainable, cash flow is vital for day-to-day operations and ensuring your firm can meet its short-term liabilities, pay employees, cover all operating expenses, and invest in its infrastructure. For small businesses (and startups), cash flow is actually more important than profitability since these small businesses often operate with tight budgets but need sufficient cash to stay afloat.

I frequently discuss methods to increase profitability. We talk about all the great things you and your firm can achieve by incrementally increasing profits. However, cash flow is the actual supply of oxygen into your firm that enables it to breathe. If you don’t have oxygen, you (your firm), will not survive. Many businesses are able to survive during unprofitable periods. Profit isn’t an existential metric. However, no business can survive without adequate cash flow.

You might have an incredibly brilliant business. Your profitability could be “off-the-charts”. Your growth could be unprecedented. But when you have a problem with cash flow, you have a problem “feeding the beast.” That makes all the high-fives you celebrate around profit and growth irrelevant. When you have a problem with cash flow, your firm will be in severe pain; you will have sleepless nights; your business will be on its deathbed.

Now, what do I mean when I say cash flow projections? Cash flow projection is the breakdown of the money you’re anticipating will come in and out of your firm. Types of cash flow you’re projecting can include what you calculate for income and other expenses. This gives you a clear idea on how much cash you'll have left over a certain amount of time.

Regardless of size, most A/E firms do a reasonable job of planning and managing their projects. Very often, this level of care is required by the client, but it is natural for the firm to do so since it directly relates to their education, profession, and passion. However, since the owners of most small to mid-sized A/E firms are not trained in business, managing the operations of the firm is not prioritized. It doesn’t come naturally.

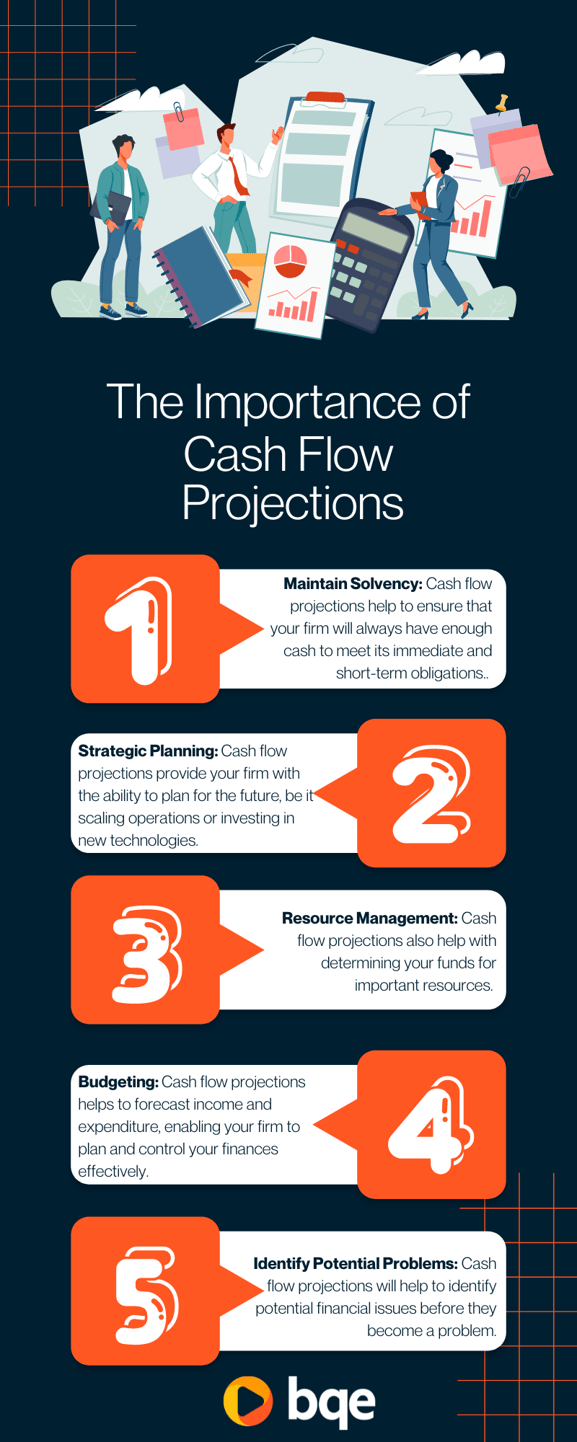

Cash flow projections are crucial for any business, including A/E firms, for the following reasons:

In order to take the pain out of performing necessary business functions, your firm needs to invest in the right technology that not only simplifies and automates things but provides you with the business intelligence to make smart decisions when they are needed. Most A/E firms invest in technology to help with the design and production of the deliverables (think CAD/BIM) but don’t have the right technology to help manage the business.

This is where products like BQE CORE become invaluable. I work with clients to implement software that manages their back-office functions while simultaneously providing benefits to all front-line personnel, from principals to project managers right down to your interns.

This is how firms amplify the benefits of their technology investment and optimize their ROI. Investing in technology that holds all the financial information for the business, the projects, and the people is the key to your firm’s success.

Whether your firm implements BQE CORE or another product, you should be looking to bring together all your business operations into a single solution, including Project Budgeting, Financial Budgeting, Time and Expense Tracking, Resource Management, Invoicing, Accounting, Revenue Forecasting, Reporting and, of course, Cash Flow Projections.

If you aren't using an all-in-one platform, and want a tool to get started with revenue projections, try out Revenue Projection Template. This free spreadsheet will help you track and project your firm's cashflow by month, but tracking all of your projects. This free spreadsheet template will help you get started, until you are ready to invest in an all-in-one firm management tool like BQE CORE.

Download the Revenue Projection Template today.

When you have a single source of truth, you have the ability to simplify and automate these important business processes and have business intelligence combined with data visualization, enabling you to be in control and ensure your firm is not only running smoothly but has sufficient oxygen (cash flow), to manifest your strategic plan.

While using a single source of truth technology is the number one way to reach your cash flow projections, you want to implement some best practices with your technology to help you get there.

Always make sure you're billing clients as soon as possible and that invoices are accurate to avoid any delays in payment. Offering a small discount for early payment could encourage faster payment, thus improving cash flow. If you’re not using an ePayments solution yet, now would be the time to consider this. EPayments can help you build a seamless invoicing system and get your money to you faster than manual processing.

Carefully set out your client payment terms. You should consider asking for a deposit up front or using progress billing, where you bill as certain milestones are achieved, rather than waiting until a project is finished.

Review your expenses regularly and try to cut down on non-essential spending. This might involve re-negotiating contracts with suppliers or switching to more cost-effective options.

Regularly forecast your cash flow to predict future cash flow issues. By knowing when you'll have cash shortages, you can make adjustments accordingly, such as deferring non-essential expenses or securing additional financing. Again, having the right software is a huge benefit here. An all-in-one solution that includes a forecasting tool will make this step easy to achieve.

Rather than relying on one or two big clients or projects, diversify your client base. This could involve seeking smaller, quicker projects that can bring in a steady stream of income while you work on larger projects.

Negotiate extended payment terms with your vendors or suppliers. This can give you a longer period to pay your bills and improve your cash flow situation.

Make sure your fees reflect the value of the work you're providing and are in line with industry standards. Regularly review and update your fees as necessary.

Utilize accounting software to automate invoicing, bill payments, and financial tracking. This can help you monitor your cash flow in real-time and make adjustments as needed.

Always try to have an emergency fund to cover unexpected expenses or disruptions in income. This provides a buffer for your cash flow.

In some cases, you might want to consider external financing such as a business line of credit, which can be used to cover cash shortfalls and then repaid when cash flow is stronger. But be careful with debt. You don't want to incur large interest payments, so don't use a Line of Credit unless you are sure you can cover the expense when you collect payments for outstanding invoices.

Remember, cash flow management involves both increasing the speed and amount of cash coming in and controlling the amount of cash going out. A balance must be struck between the two for healthy financial operations.

As you know by now, cash flow is an important part of your firm. In fact, maybe THE most important part. If you don’t have a steady cash flow, your firm will suffer. Greatly. If you’re using a manual process or outdated software, hitting your cash flow projections can be done, but it will be a lot harder.

Save yourself the time and headaches and get software that can make managing cash flow projections and managing your overall projects much easier. An all-in-one software takes care of all of this for you.

To see for yourself, try a free demo of BQE CORE today.

To help architecture, engineering, and professional services firms improve cash flow visibility and plan more effectively, we’ve created a free, editable Revenue Projection Template. This easy-to-use spreadsheet helps you track project revenue, forecast future earnings, and identify when income may fall below monthly targets, so you can spot gaps, plan ahead, and keep your firm on track toward profitability.

Steven Burns, FAIA, is a renowned global thought leader, architect, and highly sought-after speaker on topics related to emerging technologies and effective firm management. As the founder of The Well-Designed Firm, a cutting-edge business consultancy, Steven is committed to helping A/E firms elevate their business practices to the same level of elegance as the architecture they create. With a Master of Architecture degree from the prestigious Harvard Graduate School of Design and over 7 years of experience at SOM, Steven is a true expert in his field. He also founded his own architecture firm, BBA Architects, which he successfully sold in 2007. Steven's contributions to the architecture industry go beyond his work as an architect and business consultant. He is also the mastermind behind ArchiOffice, a popular project and office management software that he developed and later sold to BQE Software in 2010.

Tips to manage and improve your firm's cash flow during a difficult period with automated billing, ePayment, expanding your services, etc.

Nearly half of small businesses fail to properly manage profit and cash flow. Here are four tips to ace your business cash flow management.

If Cash is King, Cash Flow is a River of Kings - BQE Software

Be the first to know the latest insights from experts in your industry to help you master project management and deliver projects that yield delighted clients and predictable profits.