The recent update to BQE CORE (Version 1.1.140) includes a ton of new features and enhancements. With so much to unpack in the new update, it may be hard to notice a new feature that has tiptoed its way into the QuickBooks Online Integration in CORE: the ability to directly send expenses to QuickBooks Online (QBO). It was a long pending demand of users and has imparted an air of consistency to the integration process.

Integration makes creating vendor bills easy

Before this update, you could sync credit card and check expenses as expense entries from QBO into CORE, but the reverse wasn’t possible. You could only sync expenses as part of vendor bills from CORE to QBO. It didn’t feel natural for anyone who knows CORE and its intuitiveness. As a workaround for sending expenses, you first had to create vendor bills from the expenses, and then send them over. For employee expenses, you had to create a vendor for the employee, so that you could create the vendor bills for them.

The reason why CORE doesn’t send expense entries to QBO as individual expenses goes well beyond the limitations of the QuickBooks APIs used for the integration. It has more to do with another factor: the notion of expenses in QBO is different from that in CORE.

In QBO, expenses are expenditures logged by the company against a payee (could be a vendor, a customer or an employee) and they can also represent the liabilities (bills). Ergo, expenses are pure Accounts Payable (A/P) entities in QBO. In fact, the Expenses screen in QBO is more of an A/P transaction log. On the other hand, in CORE, you log expenses on behalf of the employees or vendors. They may or may not represent a liability, depending on the Reimbursable flag. Furthermore, you can link the expenses to invoices and bill them to the clients. They are not restricted to A/P alone.

From the above, you know why it makes sense to send expenses as vendor bills from CORE to QuickBooks Online. And that’s where the new feature comes in handy. Now, you no longer need to sweat on creating the vendor bills first when sending over expenses. You can directly send them as line items on vendor bills. In other words, sending over the expenses will automatically create the vendor bills on the QuickBooks side.

How to use the CORE QuickBooks integration

The working of this feature is not too different from sending other items from CORE to QBO. The only difference lies in the field mappings for the sent expenses. When you Get expenses from QBO into CORE, you map the credit card or check expenses of QBO to the expense entries of CORE, but when you Send expense entries from CORE to QBO, you map them to line items on QBO bills.

When sending over expenses, make sure you have synced all the items on which the expenses have a dependency first. You need to follow the recommended sync order for that. Moreover, for employee expenses, you have to specify a QBO vendor for which you want to send over the expenses as vendor bills. So you might still need to create a vendor version of your employee on the QuickBooks side, like you used to when following the aforementioned workaround. You can send the expenses using the Send drop-down in QuickBooks Sync Detail or even from the detailed view of expense entries.

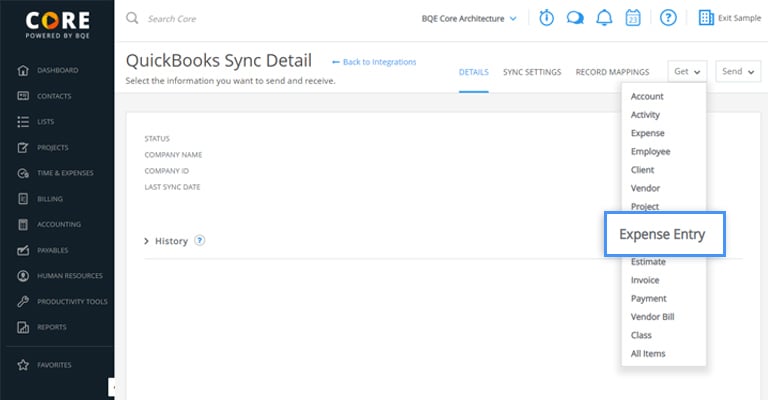

Sending expenses from QuickBooks Sync Detail

As expected, the Send Items drop-down in QuickBooks Sync Detail also contains Expense Entry now. And you need to specify a new set of Sync Settings under Expense Entry. Besides the usual settings that we have for other items too, there is an additional setting on Mapping. You can use it to map CORE employees to QBO vendors. When you send over employee expenses, CORE sends them as vendor bills for the linked QBO vendor. For vendor expenses, you don’t need to specify a vendor and they are directly synced to the corresponding vendor in QBO. After you have specified the settings, you can click on Send > Expense Entry. CORE sends over all the expenses to QBO that match the criteria set in the Sync Settings as line items on individual vendor bills. For employee expenses, CORE only sends them if you’ve mapped the employee to a QBO vendor.

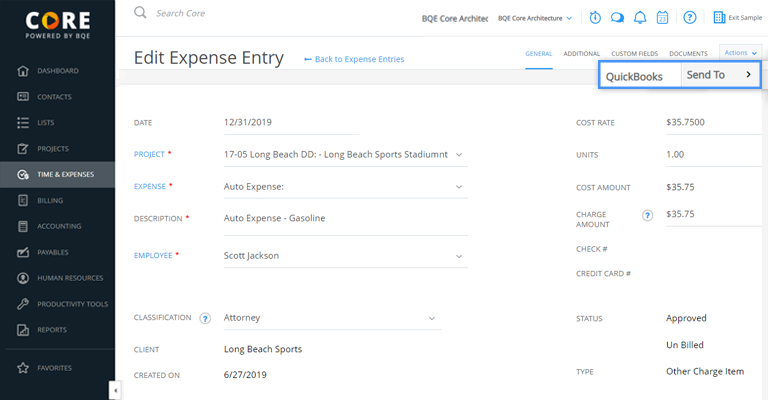

Sending expenses from expense entry details

When you open the detailed view of an expense entry, you will notice a Send to > QuickBooks option under the Actions drop-down. When you click on it for vendor expenses, CORE sends them over as vendor bills to QBO. For employee expenses, you get a prompt to select the QBO vendor to which you want to link the expense entry as a vendor bill. The prompt comes up even if you have specified a mapping in the Sync Settings. CORE overrides the mapping with the QBO vendor you specify here.

What if entries are already linked?

Worried about possible pitfalls? There are a few things you may need to think over before starting on the sync.

You might be wondering what happens if the expense entries are already linked to vendor bills in CORE. Know that for such entries, this process doesn’t apply and CORE skips them when sending over expenses. All you need to do is send over the vendor bills instead, to ensure these entries also make their way to the QuickBooks side.

Another thing to note is that when you are sending over expenses, you are effectively creating vendor bills on the QuickBooks side that don’t exist on the CORE side. But depending on your use case, you can always Get those bills back into CORE. Similarly, for employee expenses, you have to create a vendor version of your employees on the QuickBooks side. But you no longer need to do that on the CORE side, unless you want to Get the vendor bills linked to the employees from QBO. In that case, you need to Get the vendor versions of your employees from QBO to CORE before you can Get the vendor bills from there.

Having explored most aspects of this new feature, it isn’t surprising to conclude that it is sure to make life easier for people who integrate CORE with QBO on a regular basis. It gives them the flexibility that was lacking earlier and keeps things simple at the same time. After all, that’s what matters in the end.

To know more about syncing expense entries between CORE and QuickBooks Online, you have an extensive list of resources to draw from. Check out the help file and the CORE-QuickBooks Online Data Mappings document for all the details.