Employees should always contribute value to your company, whether their time is directly billable or not. Sometimes it is easy to identify your heavy hitters, but the relationship between employee value and cost is not always directly tied back to their time printed on an invoice. For example, your office manager may never track billable time, yet they may be the glue that holds a lot of your daily operations together. Plus, they might make everyone else at the firm more efficient in their work.

Yet tracking expected billable time is one of the most effective means of understanding employee performance. This is because billable time is often related directly to task versus billing analysis.

While CORE cannot tell you the true value of any one employee, we can provide you with the critical data to evaluate who has been on task, and even which services you provide outperform others. The key is breaking down billable time into utilization vs. realization.

Utilization vs. Realization of Billable Time

In general, there are two ways to calculate billable time and thus the value that your employee provides to your company: utilization and realization.

Utilization of Billable Time

This refers to the ratio between billable and non-billable hours worked by any given employee. The Utilization Rate is then calculated as a percentage of daily hours worked. Specifically, the Utilization Percentage is calculated as billable hours divided by total hours.

If an employee typically works 8 hours a day, and 6 of those are billable, then the Utilization Rate for this employee is 75%. You can then run an Employee Performance report in CORE to see if employees are meeting these expected quotas.

Tip: When setting up an employee (or vendor) record in CORE, consider updating the expected Target Utilization rate under the Rates & Options tab in the detail view.

You can also set a default Utilization Rate in Global Settings > Master Information.

For your convenience, CORE also provides in-line performance views to quickly track employee utilization.

One inherent flaw in the Utilization Rate metric is that hours is not actually an equal measurement from person to person. Although everyone's hour is made up of 60 minutes, it doesn't mean that each person will complete the same amount of work in a given hour. If you give the same task to 10 different people, it will take them 10 different amounts of time to complete. One person might take 1 hour while another takes 2. Time isn't the best metric to judge the effectiveness, productivity, or efficiency of any given individual. Thus, Utilization Rates should just be one of many ways that you review your employees and give them feedback on their strengths, weaknesses, and ways they can improve.

Realization of Billable Time

This refers to the ratio between the billable value of hours worked by an employee vs. how much you have invoiced for that time. It is simply the total value invoiced divided by the value of the billed hours logged. In other words, what you billed divided by what you could have billed.

For example:

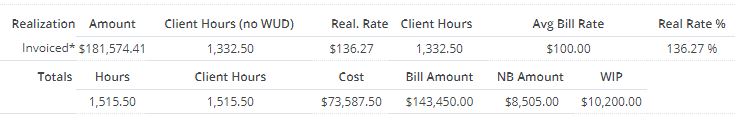

Curtis Jameson has a typical billing rate of $100 per hour.

He works 1,332.5 hours for the given period.

His time is then invoiced for $181,574.41.

Curtis would then have a Realization Rate of 136.27%, since the billed value is greater than the billable value of his logged time entries. Exceeding 100% is a good goal for your business, but it can only be achieved if you move away from hourly billing. If you bill hourly, it is impossible to achieve a higher realization rate than 100%. In effect, hourly billing limits your profitability.

Realization rates can be found on the Employees > Performance screen as well as on the Employee Performance reports.

Why Track Utilization and Realization?

Tracking employee utilization provides critical information to assist with employee reviews, task allocations, and potential revenue forecasting. Tracking realization then allows your firm to use these valuation benchmarks to better understand project profitability and sources of revenue gains or losses.

Let’s take a look at what it looks like when a firm loses out on billing the value of worked time, and then a customer fails to pay the entire invoice.

|

|

|

Revenue

|

Realization Value

|

Realization Rate

|

|

1

|

Value of Billable Work

|

$4,000

|

|

|

|

2

|

Invoice Value

|

$3,000

|

$ 3,000

|

|

|

3

|

Employee Realization

|

|

$3.000

|

75%

|

|

4

|

Fee Collection (Customer pays less than expected)

|

$2,000

|

$ 2,000

|

75%

|

|

5=2-4

|

Fee Outstanding

|

$1,000

|

$(1,000)

|

|

|

6=1-4

|

Total Realization

|

|

$ 2,000

|

50%

|

As you can see, collecting the entire payment due from a client is important (although not guaranteed), it may be just as important to understand the billable value of the time worked, as this can just as easily affect the bottom line of your firm. In the example above, losing out on both client payment and initial invoice value has caused this company to cut its earning potential in half, which is not obvious if you are simply reviewing collections of outstanding invoices.

CORE Helps You Improve Billable Value

CORE analytics are specifically designed to help you gain focus on employee performance, billing contracts, and earned value to supercharge both profitability and project performance. Other companies are using these tools to gain a cutting-edge advantage in the market. Isn’t it about time that you do too?