Maintain a Thriving Firm During Uncertain Economic Times: Webinar Highlights

BQE recently held a webinar with three business professionals that offered their advice on weathering a recession. Here are a few of their top tips.

Recessions are an unavoidable reality of any economy, and the more you're prepared, the less damage they'll cause your firm. Here are top strategic steps to take to ensure you're prepared for an economic slowdown.

June R. Jewell, CPA, is the author of the best-selling book, Find the Lost Dollars: 6 Steps to Increase Profits in Architecture, Engineering, and Environmental Firms and her new book, RAISE Your Value. June is a leading business management expert and CEO of AEC Business Solutions which provides business assessments, workshops, and training programs designed to help stop projects from leaking profits and find lost dollars. Her experience in guiding firm leaders to top industry profits has led to knowledge of the best practices for firms when there is an economic downturn.

Original blogs: 10 Tips to Survive the Next Recession and How to Prepare for the Next Recession.

I have been through at least five difficult economic downturns since starting my business in 1990. And what I witnessed is that some firms were prepared, and some were not. Some went out of business while others thrived.

I have spent many years analyzing why some firms did so much better than others. In a few cases, it was luck, in most cases it was because of careful planning, diversification and appropriate responses.

From these insights, I was able to develop a strategy to help plan for unpleasant economic situations.

Now I don’t like to label these situations as “bad” because I have seen some firms come out stronger and more competitive after a recession. In fact, just the way you think about it can make a difference in the outcome. If your firm thrives and some of your competitors fail, your firm could be in a much stronger competitive position after a recession ends.

There are only three possible scenarios that you may find your firm in the coming years:

Worse off than before

The same as before

Better off than before

The answer as to which one you will experience may be up to you and how you respond.

To build a strong recession plan, you need to look at all the possible scenarios that your firm could face. In each of these scenarios, you’ll discover there are certain factors that will influence your immediate, short-term, and long-term actions.

The key to a good business strategy is to determine what those factors are, how much control you have over them, and what you’ll need to do to mitigate any negative results that you can anticipate.

When a recession is combined with other factors such as a pandemic or national emergency, every possible issue impacting your team and projects should be considered.

Most firm owners immediately focus on financial factors. However, there are several other critical factors that should get just as much attention:

Key clients and employees

Subcontractors

Current projects in progress

Continuity of key business processes such as site work/capturing of field data, access to systems, timesheets and billing

What it all comes down to in determining whether you’re going to be worse off after a recession or better off is how prepared your firm is heading into a recession.

If you have a recession-proof strategy in place, you can quickly implement your plan without all the scrambling around that often ensues when disaster hits.

When you have a strategy in advance, you can spring into action when crisis hits and not have to spend countless hours meeting to discuss all your possible actions. Your plan will give you the roadmap to act quickly, no matter what happens, and successfully communicate with your staff, clients, and vendors.

Without this level of planning, you’ll have to spend weeks or longer figuring out which actions to take, how to prioritize them, and how to communicate this plan internally and externally.

Instead, you can speak with key clients, evaluate market information, and reassure employees and key stakeholders to reduce panic right away.

So, what can you do to prepare for the next recession?

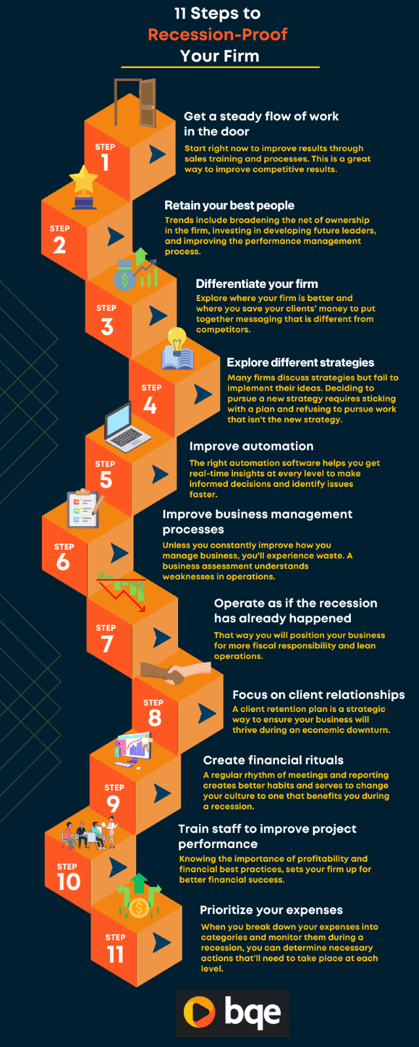

I believe there are at least 11 strategic moves you can focus on that will make your company financially and operationally stronger and enable you to survive possible tough economic times ahead – regardless of whether that is next year or five years from now.

When you enable a number of these business management improvements, this will also help your firm to grow and thrive even if there is not another downturn (but based on what we know throughout history, there will be...):

While this may sound obvious, it should always be mentioned in your strategy, especially if you want to come out of a recession stronger than ever.

You’re probably no doubt working on this as we speak, but often when times are good and we’re slammed with projects, we lose focus on expanding our client list.

Start right now to improve results through sales training and process improvement. This is a great way to improve competitive results.

Retaining your best staff is critical to firm success, yet I don’t think that the industry overall is very innovative in rewarding, developing, and recognizing our top performers.

A common theme I’ve seen in firms that weather a recession and come out stronger is how they invest in a strong team to help carry them through. This can be done by broadening the net of ownership in the firm, investing in developing future leaders, and improving the performance management process and approach.

A more professional approach to employee success will help to keep employees satisfied and committed.

And when you have a team of satisfied employees, you don’t have to worry about suddenly needing to hire and train right as a recession is happening.

Breaking the commoditization trap is something that many firms struggle with. Even though work is plentiful, pricing your services based on the value you offer clients is still a new concept for many firms.

By understanding where your firm is superior and where you save your clients’ money, you can start to put together messaging that distinguishes you from your competitors. This will always make you stand out from the crowd and get more people in your door looking for your services and paying the right price for your expertise.

4. Explore different strategies

Many firms meet on an annual basis to discuss strategy, but they either don’t explore new options or fail to implement the ideas from these retreats.

Deciding to pursue a new strategy – whether it is a new line of business, additional client industries to pursue, different services to offer, or different geography to support - requires sticking with a plan and refusing to pursue work that is not in line with the new strategy.

Make sure your “Go / No-Go" process is in line with your strategy and communicated to your entire team.

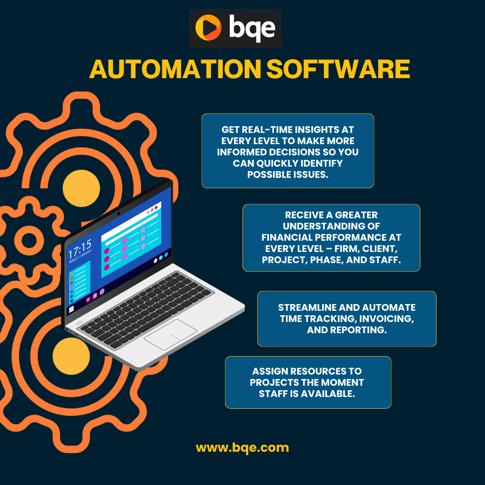

5. Improve automation

Being efficient and automated gives you a competitive advantage and allows you to be leaner in the event of a recession.

Technology is cheaper than human capital, and optimizing the use of the systems you have already invested in is a great start.

Those firms that use their systems, and especially those systems that improve project management, already have a competitive advantage.

If your current processes are manual, or you’ve invested in firm operations software that is either too difficult for your team or isn’t giving you the features and results you need, it’s time to spend your money on software that is the right fit for your firm to help you automate tasks and focus on delivery.

The right automation software can help you get real-time insights so you can stay prepared no matter what happens in the ever-changing economy.

6. Improve business management processes

Many firms are still doing things the way that they have been done for years.

Unless you are constantly improving how you manage your business, you are falling further behind and will experience waste.

Inefficiency comes in many flavors including redundancy, non-integrated systems, spreadsheets and inconsistency between offices, and teams.

A business management assessment is a great first step to understanding weaknesses in business operations and providing a clear path for improvement.

7. Operate as if the recession has already happened

Many firms wait until it’s too late to make the needed changes to their spending, hiring and investing practices.

By operating as if work is hard to get, you’ll position your business for more fiscal responsibility and lean operations.

The only caveat to this advice is to ensure that you continue to invest in areas of the business that’ll give you leverage and improve project performance.

Your existing clients are your source of future success. However, not all clients are created equal.

Make sure you are focusing on those clients that provide the most profit and growth potential for your company. Many firms do not intentionally focus on how to grow their business through existing client relationships.

A client retention plan for your best clients is a strategic way to ensure your business will thrive during an economic downturn.

9. Create financial rituals

One of the challenges that many A/E, consulting, and professional services industry leaders struggle with is holding project managers (PMs) and employees accountable for hitting goals and achieving financial results.

When I explore firms that didn’t do well during a recession, I often see a lack of financial rituals, including regular meetings, to keep focus on metrics and financial progress.

Your teams are very busy and often we fail to pay attention to key numbers until it is too late. A regular rhythm of meetings and reporting will create better habits and serve to change your culture to one that will benefit you greatly during a recession.

10. Train staff to improve project performance

Many firms lose money on projects because of all the gaps identified above that lead to scope creep, inefficiencies, and lack of accountability.

By training PMs and other technical staff about the importance of profitability and financial best practices, you can set your firm up for better financial success and eliminate costly budget overruns.

Your expenses should be evaluated and weighted for importance in the event your cash flow slows, and expenses need to be cut.

For easier review, break your expenses into major categories and then into subcategories.

Example:

Major Category: Employees

Subcategories: Salaries, insurance, 401K, other benefits, current hiring efforts, etc.

Then, key leaders can be assigned to each category to report, adjust, or even stop expenses if necessary.

When you break down your expenses into categories and monitor them during a recession, you can determine necessary actions that’ll need to take place at each level including layoffs, salary adjustments, reducing 401K match, etc. to help your firm weather the recession.

When there’s an economic downturn, it’s important to look at the lessons you’ve learned during this time and make the most of them. Look at what worked and what didn’t work, where your firm can be technologically stronger, and how you can reduce risk in the future. Put your plan in writing and let your team know that you are preparing for the worst but planning for the best.

By preparing for the worst–case scenario, good judgement will prevail, and the stress and agony of your toughest decisions will be reduced next time you have to face the uncertainty of a recession (and you will).

By increasing the operational and financial performance of your firm, you can make your firm more valuable, efficient, and better prepared for any economic climate.

Whether the next recession is big or small, long or short, having a prepared strategy in place for a lean and operationally optimized business will go a long way towards long term survival and growth.

June R. Jewell, CPA, is a highly respected business management expert with a passion for helping architecture and engineering firm leaders improve their profits, culture, processes, and systems. With a focus on training all team members for high performance, June is committed to ensuring that her clients achieve their goals and reach their full potential. As the best-selling author of "Find the Lost Dollars: 6 Steps to Increase Profits in Architecture, Engineering and Environmental Firms," June has become a go-to resource for industry professionals seeking to improve their bottom line. Her expert guidance and proven strategies have helped countless businesses maximize their profits and realize their full potential. June is the CEO of AEC Business Solutions, a leading provider of business assessments, training programs, workshops, and process improvement services. Through her work with AEC Business Solutions, June has helped numerous clients identify and eliminate profit leaks, increase efficiency, and find lost dollars in nine key areas of business.

BQE recently held a webinar with three business professionals that offered their advice on weathering a recession. Here are a few of their top tips.

8 things that small businesses can do to survive an economic downturn in a better position

Learn tips to remain profitable and ensure business success through an economic downturn by preparing a smart business strategy during a recession.

Be the first to know the latest insights from experts in your industry to help you master project management and deliver projects that yield delighted clients and predictable profits.