Tips to Master Your Project Life Cycle

Steven Burns FAIA discusses the top tips for a strong project life cycle from building a perfect checklist to monitoring and controlling your...

Discover the best practices for setting up a strong chart of accounts such as the hierarchy and structure and how to ensure it remains scalable.

I’m impressed that you have stopped to read this article. Most service professionals don’t think about their accounting software, no less the foundational pieces of it. As an architect, I was mesmerized when I first learned about what was happening inside our accounting system. I was like a poker player learning to count cards and realizing I could have an incredible edge against the competition (or the Casino).

This revelation underscored the importance of not just having an accounting system, or even simply software such as QuickBooks, but truly understanding its inner workings. With the right setup and understanding, you're not merely tracking numbers; you're strategizing for a stronger, more prosperous firm. Dive in with me, and together we'll unravel the complexities of setting up a COA tailored for architects.

A well-considered chart of accounts (COA) is essential for architects and other business owners who wish to understand and manage their finances effectively. The COA is the backbone of your accounting system. It offers a structured list of accounts that are used to categorize financial transactions. When starting a new company, your accounting software will provide you with a default COA. This is a fine place to start unless you already have accounting experience or work with an astute bookkeeper, accountant, or CPA.

Business owners regularly look at two reports: the Balance Sheet and the Profit and Loss (or Income) Statement. They are typically looking for bottom-line information like, did we make a profit last month (and how much), what is the current (book) value of our company, or how much money do I have in my bank accounts and how much do I owe people—high-level information. However, looking deeper into these financial statements, you will learn more about what is happening.

It’s like looking at anything. When you simply glance with bare eyes at your financial reports, you’ll know surface information. But put them under a microscope, and you can see the truth underlying the general information your eyes understand.

The COA is the way to organize every financial transaction that happens within your firm. The more granular the breakdown, the more you will understand the health of your firm. As mentioned earlier, most owners look at the bottom line of the P&L and get either a good or bad feeling: either they made a profit or lost money during that period. But a great chart of accounts will tell the story behind why the bottom line looks the way it does.

When you have a well-developed COA, you have the ability to make intelligent decisions. You’ll see where to look more closely if you're losing money. If you’re making money, you’ll see which profit center is responsible and look to exploit it further. The list of decisions you can make is limitless based on the ability of your COA to tell a detailed story.

When you have a beautifully organized COA, you will immediately appreciate the benefits:

A comprehensive COA gives insight into income sources and expenditure patterns. For architects, this could mean understanding which types of projects are most profitable or which expenses are the most significant. Most firms will have a single income account type for tracking the fees they earn for their professional services. Consider breaking these down into project types unless you use an intelligent business and project accounting solution like BQE CORE. Wouldn’t it be more beneficial to learn that 45% of your revenue is derived from commercial work, 25% from residential, and 30% from hospitality?

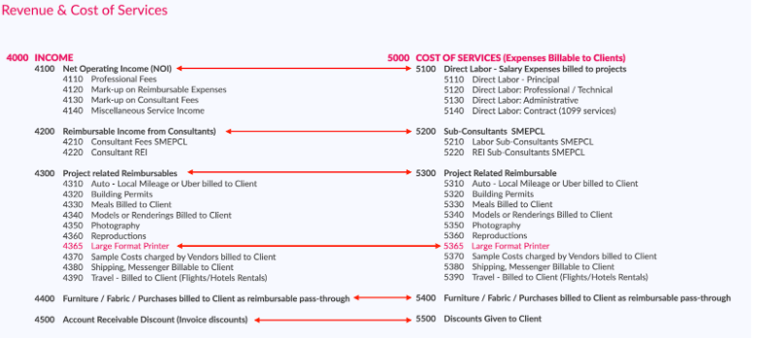

Whenever I work with clients, whether a large or small business, I explain how to balance the COA to provide immediate insight. For example, a large format printer should be recognized in two different areas of your COA. Assuming you bill your client for project-related prints, you will recognize that particular income in a unique account in the 4000 area of the COA. This is the main silo for all income. In addition, you will also track all expenses incurred to operate that printer (maintenance, ink, paper), in the 5000 area of the COA. That is typically the area where you track all direct labor and expenses.

In the Income account 4365, all income from the large format printer is recorded

In the Expense account 5365, all expenses for the large format printer are recorded.

With proper reporting, you will instantly see if that printer is a profit center.

Here is an example of a balanced COA with regard to Income and Cost of Services:

With a clear financial picture, your firm can make better decisions related to scaling, investments, hiring, etc. Informed decision-making is pivotal for architectural firms striving to thrive in an evolving market. By setting up a comprehensive chart of accounts, including new accounts tailored to specific financial streams, your firm gains a transparent view of its cash flow, from payable expenses to incoming revenue. This clarity not only aids in managing asset accounts more effectively but also provides insights into where profits are maximized. In the previous example, you might just learn that your large format printer is the single-biggest profit center for your firm and consider (like one of my clients once joked), changing your business from professional services to printing services!

A proper COA makes it easier for firms to set budgets and forecast future financial scenarios. When you can track your business expenses into detailed silos, you not only learn where all that hard-earned money is being spent, but you can also learn about which expenses are unnecessary. When you prepare an annual budget, you can track the actual income and expenses against your forecast and make changes as necessary. If all you have is a P&L without comparing that to a budget, you are really flying by the seat of your pants.

A consistent COA ensures they remain compliant for firms that must adhere to specific financial regulations or standards. Even if you don’t think your firm needs to comply with government (or other) regulations, you’ll want to follow these best practices. It’s better to be prepared in the event that someday you will need to comply.

With all accounts properly categorized, tax-related calculations and deductions become more straightforward. Your CPA or tax accountant will guide you as to which accounts they will want you to have.

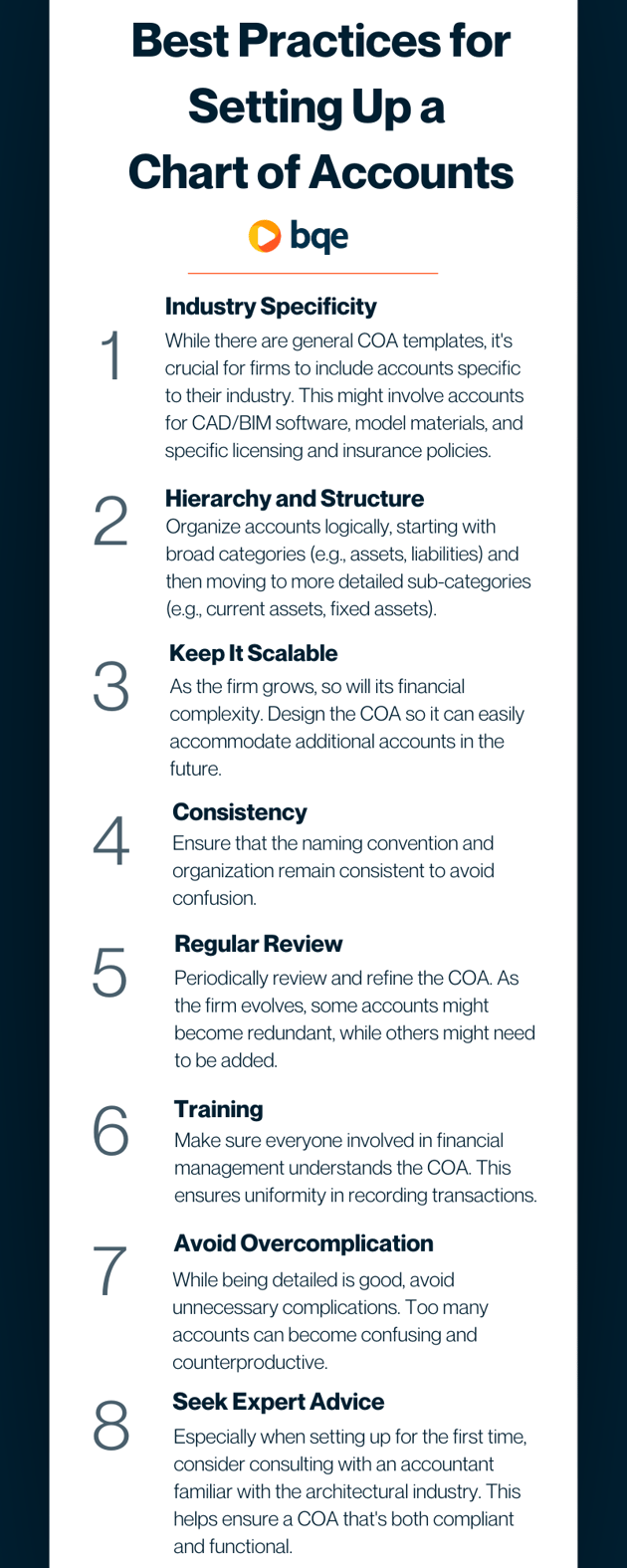

Industry specificity plays a paramount role in ensuring the precision of a COA tailored for architectural firms. While general COA templates serve as a foundational guide, the nuances of the architecture industry necessitate the incorporation of accounts that capture every business transaction unique to this field. This might mean detailing types of accounts for expenses like CAD/BIM software, model materials, and specialized licensing and insurance policies. By honing in on these industry-specific accounts, your firm can gain a more accurate assessment of your financial health, enabling better decision-making and strategic planning.

Organize accounts logically, starting with broad categories (e.g., assets, liabilities) and then moving to more detailed sub-categories (e.g., current assets, fixed assets). But don’t stop there. For example, under Shareholder Equity (3000), you should have sections for each shareholder. Or, for Expenses (6000), you should group these into categories like Business Development (6020), with sub-accounts for Networking Functions, Gifts, Business Meals, etc.), and Marketing (6060), with sub-accounts for Brochure, Photography, Website, Social Media, etc.

As the firm grows, so will its financial complexity. Design the COA so it can easily accommodate additional accounts in the future. When designing the COA for an architectural firm, it should be structured to effortlessly accommodate additional accounts, including revenue accounts that detail various income streams. As the firm expands and diversifies its services, the COA should be adaptable enough to reflect these changes accurately on the income statement. This foresight ensures a smoother transition during periods of growth, allowing for a clearer financial overview and strategic planning.

This means being consistent not only with the account name but also with account numbers. By ensuring both the name and the numerical identifiers follow a consistent pattern, architectural firms can sidestep potential confusion and misinterpretations. This uniformity fosters clearer communication and understanding among stakeholders, simplifying the tracking and reporting processes.

Periodically review and refine the COA. As your firm evolves, some accounts might become redundant, while others might need to be added. Regularly revisiting the COA, especially within the framework of the general ledger, is essential to ensure its ongoing relevance. As your firm undergoes evolution and growth, some accounts, including equity accounts, might become redundant or obsolete, necessitating their removal or modification. Conversely, the emergence of new financial avenues might warrant the addition of new accounts. This periodic review ensures that the COA remains a true reflection of your firm's financial structure and needs.

Integral to business accounting is not only the establishment of a clear chart of accounts but also ensuring that everyone involved in financial management is well-versed in its intricacies. By prioritizing training for team members, firms can guarantee a standardized approach to recording transactions. This shared understanding promotes uniformity, minimizes errors, and establishes a coherent financial foundation upon which your firm can confidently build and make decisions

While it's commendable to have a detailed view of accounts, including those pertaining to accounts receivable and liability accounts, it's crucial to steer clear of unnecessary complications. Creating too many accounts or overly segmented categories can lead to confusion and can actually hamper the efficient management of financial resources. Striking the right balance ensures that your firm captures essential financial details without becoming counterproductive in its approach.

Embarking on the journey of business accounting, especially when delving into areas like balance sheet accounts and the cost of goods sold, can be intricate. Especially for architectural firms setting up their chart of accounts for the first time, it's prudent to consult with an accountant who has expertise in the architectural industry. Their insights can help shape a COA that is not only compliant with industry standards and regulations but also maximally functional, ensuring that your firm has a robust and effective financial foundation.

If you would like to see what I consider to be the Perfect Chart of Accounts, let me know and I’ll send the list to you. Or we can work together to make your firm as well-designed as the projects you create for your clients.

Now that you’ve read this blog, it’s time to expand your knowledge of building a strong Chart of Accounts by taking it one step further. BQE Software’s free on-demand webinar, “How to Organize Your Chart of Accounts to Understand Firm Profitability” will give you an even deeper understanding of setting up your COA.

Douglas Teiger, FAIA, helps you better understand your chart of accounts and how to increase your firm's profitability in this free on-demand webinar.

Steven Burns, FAIA, is a renowned global thought leader, architect, and highly sought-after speaker on topics related to emerging technologies and effective firm management. As the founder of The Well-Designed Firm, a cutting-edge business consultancy, Steven is committed to helping A/E firms elevate their business practices to the same level of elegance as the architecture they create. With a Master of Architecture degree from the prestigious Harvard Graduate School of Design and over 7 years of experience at SOM, Steven is a true expert in his field. He also founded his own architecture firm, BBA Architects, which he successfully sold in 2007. Steven's contributions to the architecture industry go beyond his work as an architect and business consultant. He is also the mastermind behind ArchiOffice, a popular project and office management software that he developed and later sold to BQE Software in 2010.

Steven Burns FAIA discusses the top tips for a strong project life cycle from building a perfect checklist to monitoring and controlling your...

To celebrate International Women's Day, we compiled a short list of some of the most influential women in architecture and design .

How to Promote Your Business with Freebies and Still Make a Profit - BQE Software

Be the first to know the latest insights from experts in your industry to help you master project management and deliver projects that yield delighted clients and predictable profits.