Steven Burns, FAIA was Managing Principal of Burns + Beyerl Architects for 15 years before selling the firm to pursue a career in software where he developed ArchiOffice and EngineerOffice. In 2009, BQE Software acquired Steve’s software company. He currently serves as Chief Creative Officer, refining BQE’s business strategy and product development for their groundbreaking project management and accounting solution, BQE CORE.

In a recent blog post titled The Dirty Little Secret They Don’t Tell You About Job Cost Accounting, I discussed the fact that there are so many things that happen within a firm that just aren’t being tracked properly and in-fact, never really get included in the total costs that the firm invests in their projects.

This problem exists because most firms don’t have the technology tools that make it effortless, or even possible to calculate job costing.

This problem exists because most firms don’t have the technology tools that make it effortless, or even possible to calculate job costing.

Consider each project a mini-business

After spending decades working on this problem, I believe I’ve found an easy way to get this point across. First, I would like you to consider that every project you and your firm works on should be considered as a standalone company.

When thinking this way, you would also recognize that the project manager is actually the CEO of that standalone company and as such, needs to have, at all times, the right information to ensure this project is profitable.

This concept is not radical. Indeed, there’s been a trend lately for project managers to be considered as business managers. This implies the understanding that they are managing their own little business. It just so happens that that little business is typically referred to as a project.

Run your profit and loss statement

The most important report for any business is the profit and loss statement (or income statement). This is often rather simple to run since accounting software, by definition, accounts for every contributor to income and every single expense.

Even if they are miscategorized within the associated chart of accounts, the math always works out: Income - Expense = Profit. And while there is often confusion amongst small business owners as to why their P&L statement is telling them they have a profit, yet that doesn’t equal the cash they have in the bank, this statement is without mystery. The confusion has to do with the differences between cash and accrual accounting practices which we can discuss in a future article.

Spot trends

When a P&L is done properly it’s easy to spot trends and find out what works well, what doesn’t and find the most profitable part of a business.

For example, when my firm purchased our first large-format printer and started tracking all the expendables that go into its operation (ink, paper and maintenance), and then started to see the income it generated as a reimbursable expense, my partner and I realized that this was the single biggest profit center in our office.

Identify opportunity cost

We used to joke that we should stop providing architectural services and become a print shop. It was the ability to track every cost against an asset and compare it to the revenue garnered that we were able to determine the opportunity cost of investing in a printer.

We didn’t actually go down that route of changing our business plan and become a print shop, Afterall, we were architects trying to find the best way to create a thriving and profitable architectural firm.

Apply chart of accounts to job costing

It was this lesson however that taught us that a well designed chart of accounts can reveal amazingly interesting facts about the economics of your firm. When you apply this same principal to calculate job costing you will learn similarly eye-opening facts.

You will be able to draw connections between profitability and client, profitability and project manager, profitability and principal-in-charge, profitability and employee, and even profitability and contract type (i.e. fixed fee vs hourly). You can even find out profitability as it relates to the individual activities you do within a project. If you’re able to achieve this, you truly have figured out how to calculate job cost accounting.

Use job costing software

In order to achieve the objective of calculating job costing, one must have software that makes this possible and easy. You can never expect to achieve this by using spreadsheets. The amount of attention that would be required to track everything via spreadsheets is not only daunting - but the process is filled with potential for errors.

The only way is to use sophisticated technology.

The only way is to use sophisticated technology.

Very few accounting programs can do this. QuickBooks and Xero are lovely accounting software programs and they’ll be able to give you the high-level Profit & Loss statements most businesses need. But don’t expect to be able to capture every penny at the project level using these programs. For this you really need a solution that's built for job cost accounting.

Link expenses to specific jobs

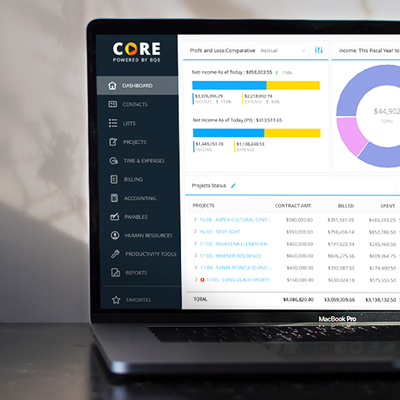

When you use systems like BQE CORE to manage your accounting, you never have to worry that any single item is not being tracked back to the project. That is because every expense must be linked to a job (either billable or overhead).

For example, every hour your staff is spending that is associated with the project is known (both cost rate and bill rate). In addition, every expense (both billable and non-billable), are linked to the job. Every vendor bill, every consultant, every purchase order is linked to the associated job.

BQE CORE is smart enough to know that if you have outside contractors who are providing you with their timecard - CORE will know that they may cost you $25/hour on project A and $28 on project B. The system also knows that if their time is billable to the client that they might be billing out at $135/hour on project A and $120/hour on project B.

Let your platform remember for you

It’s the BQE CORE platform that is keeping track of this so that no individual has to remember what things cost, what things bill out for and whether these items are even being recorded to the appropriate projects. With a system like this you actually have to go out-of-your-way to make an error.

Schedule automated reports

Now that you’re using a job costing software like BQE CORE, you’ll be able to either see on live dashboards or through automated reports that your jobs have clear costs that include everything invested in them.

Running a project Profit/Loss report means that your managers will instantly understand if they are doing a good job in the same way that firm owners can see from their company P&L if the business is healthy.

Analyze revenue earned against cost

There’s one more wonderful thing that one learns when they develop a robust activity list and have a system that can analyze the revenue earned against the costs of performing this work.

Having this ammunition means you also have information that will lead you to create better proposals for future projects.

As a simple example, one of our customers learned through reporting from BQE CORE that whenever their employees spent time participating in in-house, client meetings the projects become less profitable and the individual employees saw their realization rates drop below what CORE had determined was the minimum acceptable.

The firm used this information to modify their contracts so that client meetings held “in-house” were billed hourly whereas client meetings held at the client’s office were part of their basic services.

After analyzing this phenomenon, it was determined that whenever the client came to their office, the team was encouraged to join in the meeting and the client loved being in their office and “playing” with the team. It’s hard to ask the client to leave. Changing their contracts was a subtle way of ensuring their team achieves high efficiency and the projects achieves its profit potential.

Want more tips to increase efficiency and improve your bottom line? Click below to download a free white paper on the Definitive Guide to Project Accounting.