There’s a reason why you hear so much about cash flow—it’s often a make or break factor for businesses. According to Fundbox, late payments plague professional services fields, especially those of construction and accounting. PSMJ notes that for the AEC industry, it typically takes between 90 and 120 days for a firm’s invoices to be paid. That’s a whole lot of time for the money you earned to just sit in someone else’s bank account!

This is why we’re returning to this continually important topic and offering you 12 suggestions to increase your cash flow, ranging from contract negotiations all the way through to collections.

1. Ask for Retainers: Retainers are common in certain professional services fields like law, but are rarely seen in others (e.g., architecture). However, they serve a purpose across the board. They’re simply upfront payments for future work and services, and they stand as a commitment from clients to maintain a stable financial relationship with you.

Retainers help you cover costs incurred throughout your work process, letting you worry much less about cash flow (and delinquent clients). It’s a good practice to estimate your average invoice value to use as your retainer fee, bill it to the client upfront, and then apply that to your final invoice.

2. Establish a Time Review & Billing Routine: Our research has shown that the biggest factor in billing delays is due to pending approvals from decision-makers. Consequently, you should have a weekly routine for any approvals needed in your time and billing process. Make a point of it by reserving time on managers’ and principals’ schedules for them to review everything they need to.

3. Use Progress Billing: Progress billing is a method that’s many software providers don’t offer despite it being incredibly useful for increasing cash flow. It entails billing your client at different stages of a project or job, and has two key use cases. You can also learn more about progress billing in BQE CORE here.

Fixed Fee Projects: If you work based on fixed fee projects, you might be used to getting paid only once all of your work is finished. Naturally, this means that you’re footing expenses and losing money until you get paid back. With progress billing, you can invoice portions of your contract and receive continual payments throughout the process.

Late Time and Expenses: Another use for progress billing is to work around late time and expense entries. You can go ahead and bill your clients even if your staff hasn’t entered their time cards, and then assign the proper time and expenses after the fact.

4. Sync Your Billing With the Client’s Bill Payment Cycle: It can be worthwhile to ask your clients when they typically pay their bills and then send your invoices out a week before that. This way, you don’t become a victim of someone else’s schedule.

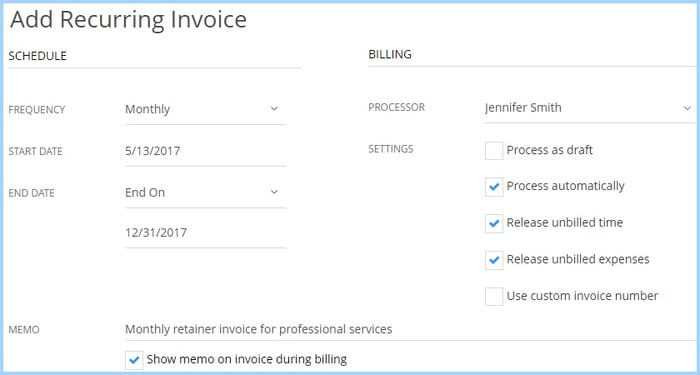

If you use invoicing software that offers automatic billing, you can make the process simpler by setting custom dates to correlate with your client’s payment cycle.

Your software should make it easy to set up automatic bills.

5. Pay Attention to Invoice Setup: The information that you choose to show—or not show—on your invoices can have a surprisingly large effect on how your client reacts. If you know that some clients always respond to your invoices by asking for more detail, consider itemizing them in order to pre-empt any questions. Conversely, if you know that they argue every item, perhaps you should summarize the information on your invoices.

Even if you’re doing stipulated sum billing, this can apply to you when you bill for additional services or expenses.

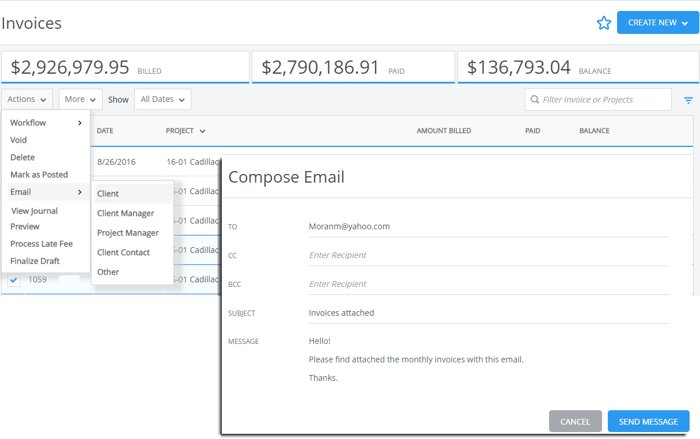

6. Send Invoices via Email: If you mail your invoices, you’re effectively prolonging the payment process. Papers can get lost, and the money spent on postage can add up. Sending them by email instead avoids these pitfalls. Clients will receive your invoices as soon as you send them, and they can easily view them from any device.

In CORE, emailing your invoices is simple.

7. Specify a Due Date - As we’ve noted, small changes in language can have an outsized effect on a client’s behavior. On your invoices, you should pinpoint the date that payment is due, rather than just describing a time period. “Due by Wednesday, February 14, 2018” is clearer and more commanding than “due within 14 days of receipt.”

8. Make Invoices Due Upon Receipt: You’ll speed up your cash flow even more if you make your invoices due upon receipt. This effectively makes payment instantaneous, especially if you’re sending your bills electronically.

CORE (and BillQuick V19) make it simple to set this payment term as a default across your clients or projects.

9. Offer Early Pay Discounts: Make your clients happy and increase your cash flow by agreeing to a small discount if they pay their invoices early. The most common way of doing this is by offering 2/10 net 30 terms. This means that clients are expected to pay within 30 days of receipt, and they’ll get a 2% discount if they pay within the first 10 days of that period.

10. Charge Late Fees: Late fees are an excellent motivator for otherwise slow-to-pay clients. With a couple of caveats, you should absolutely consider implementing them if your A/R is getting ridiculous.

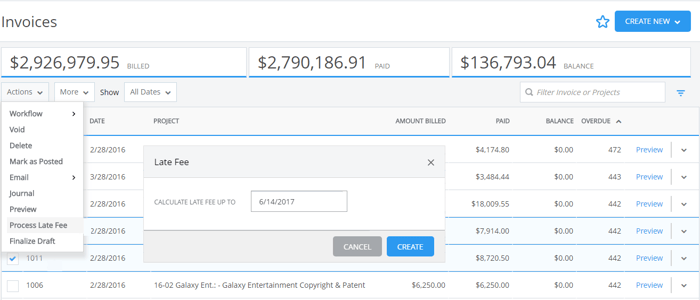

Businesses usually calculate late fees on the last invoice for a project, and the client will pay it with the last payment. In some cases, though, companies prefer to calculate late fees on each outstanding invoice and clients have to pay it for every such invoice. In CORE, you can calculate late fees on the outstanding balance or invoice amounts based on a specified date. Furthermore, you can do this at the project or global level, so you don’t need to manually add the late fee to every relevant invoice.

Ensure that you clearly communicate what the fee is, both in your contract and on every invoice. Don’t hide anything in the fine print. After all, late fees are meant to get clients moving, not to swindle them. Along those lines, keep in mind that there are legal limits on interest rates, and don’t treat late fees as an extra revenue stream. Additionally, you may want to waive the fee if a client is experiencing some kind of extenuating circumstance.

In CORE, it only takes a few seconds to add a late fee.

11. Monitor Your A/R: When they go past a certain date, overdue invoices can seem like they’re lost to the ages. Don’t let them get to that point! Instead, use your accounting software to consistently check in on your accounts receivable. BQE CORE’s invoice collections screen offers a handy way of looking in on all your A/R at once. You can also run various reports about collection calls, aging, and details.

12. Have Your Managers Make the Call: While your A/R person is there to manage, well, A/R, your managers have an important role to play. If invoices are past due, let your managers call their clients instead. We’ve found that collection calls from project managers have a higher success rate than those from A/R departments, likely because clients have more personal relationships with them.

Now, note that cash flow is directly controlled by two factors: the days between when the services were provided and the invoice was sent, and the days between when the invoice was sent and then paid. With these 12 suggestions, you should have no problem cutting down on that lag time.