How & Why You Should e-File Your Business's Taxes This Year

Good news: electronically filing your business taxes can take out much of the tax filing anxiety and streamline this process for your company.

Working papers support the professional judgement for actions taken while providing bookkeeping, financials, taxes, or other service to that client.

The term “working papers” refers to the documents that an accountant or tax professional uses or creates in the course of their work for a client.

The work papers support their professional judgement for the actions they took in providing the bookkeeping, financials, taxes or other services to that client.

For accounting purposes, these work papers provide the rationale for their assessment of and confidence in a business’ financial statements and are scrutinized by financial auditors when evaluating the business.

For tax purposes, the working papers show the due diligence performed by the tax professional, as well as their judgement and reasoning for applying certain tax deductions, credits or other tax treatment to a return.

.png?width=495&height=495&name=Types%20of%20Working%20Papers%20(1).png)

A common type of accounting work paper (also referred to as workpapers) is the worksheet, which are used for various purposes, such as summarizing year-end processes, posting adjusting entries to the journal, creating a trial balance, or preparing a business’ financial statements.

Working papers are also essential in tracking and recording accounts receivable and payable transactions, activities involving asset acquisition or disposals, liabilities and other client records.

For tax working papers, a simple example would be the documents produced while a tax professional is preparing a simple Form 1040 income tax return for a client.

These would include client documents like W-2s, 1099s and 1098s, as well as any notes they took while meeting with the client, receipts, contracts and proof of any changes in residency or marital status.

The working papers are often used when responding to IRS inquiries or defending against a tax audit.

When it comes to tax and accounting, there are two commons types of audits: Financial and Tax. Both are completely different concepts, performed by different types of professionals, with different purposes.

A financial audit examines the fiscal operations of an organization and are periodically required by government regulators for all publicly-traded corporations, local governments, and nonprofit organizations to ensure they are following legal guidelines.

Many small and medium sized businesses also are required by their lenders or investors to conduct audits to ensure the business is being run legitimately and efficiently.

The audits are generally performed by certified public accountants working for outside accounting firms that do not represent the business in other matters.

In the U.S., the term audit may make many instinctively think of the Internal Revenue Service, which has the authority to review the annual tax returns and income of all citizens and residents, as well as all businesses and other organizations that are required to report income.

These audits are exclusively performed by officials of the IRS.

Whether the auditor is examining the financial operations of a company or the taxes of a business or individual, the auditor is tasked with verifying the legitimacy of the materials.

This includes documentation of income, correspondence and proof of qualification for certain issues.

.png?width=340&height=340&name=working%20papers%20tax%20audit%20(1).png)

For an examination of an organization’s books, the auditors generally start with the financial statements and drill down to underlying components of the balance sheet.

To do this, they require full access to the company’s financial systems and randomly test samples of accounting transactions to ensure that they have been posted properly.

The auditors will verify financial account information, income, expenses, taxes, creditors and debtors, and will assess the accounting software used, controls and security the business has in place to prevent fraud and unauthorized access to sensitive data.

Other areas that are scrutinized are the general ledger, accounts receivable, accounts payable, and asset inventories. With the increased use of electronic financial transactions, these processes are very central to audit focus.

The senior management of a business should collaborate with the audit representative to ensure they have access to all data and areas of the business they deem appropriate, and to help minimize disruption to business operations.

In years past, an audit often meant having audit staff on-site for the duration, which could be a couple of weeks, but modern computing and cloud technologies allow some of the work to be done remotely and less obtrusively.

The audit team may also interview business staff regarding operations, governance, technology, personnel management and industry trends.

The end product is an Auditor’s Report in which an opinion is given as to whether the auditor has confidence that the organization’s financial reports are is in compliance with generally accepted accounting principles (or other mandated accounting principles).

The report also offers an assessment of risk, and whether there are unusual factors that should be considered.

The ideal result, for the business being audited, is an unqualified, or “clean,” which means that, in the opinion of the auditor, the financial statements are accurate and conform to GAAP.

As noted previously, in the U.S., tax audits are conducted by agents or supporting staff of the Internal Revenue Service.

The tax audits they perform may take place via correspondence (simple requests for information), in-person at IRS offices or, in some instances, at the property of the business or individual whose taxes are being inspected.

It is important to remember that not all tax audits are the same.

They may only be a simple request for missing documentation, or a request for additional information to support a tax deduction or credit. Conversely, they can be a harrowing and thorough inspection by agents if they suspect tax fraud. In the latter case, agents may require access to all the same personal or business financial documents as a financial audit.

However, they are usually focused on proving or disproving items related to income, expenses and qualification for specific tax deductions and credits.

IRS agents can go back several years, so taxpayers or businesses should have their tax documents organized by year.

This includes proof of income, documentation supporting expenses, credit card and bank statements, business financial records, divorce records, business ownership changes, etc. Fortunately, the IRS usually asks for specific documentation, unless serious problems are discovered in the process.

A CPA, Enrolled Agent, or tax attorney can represent a business or individual before the IRS and can coordinate with the agency to provide them with the documentation they need.

We are now in the 21st century, and working papers should be, too. That means getting paper documents into a digital format, or starting documents digital and keeping them digital, which enables more efficient management, access and collaboration.

This starts with a solid business management system like BQE CORE, which maintains user activities and transactions, security and control features, as well as reporting to help in preparing financial documents.

Original paper versions of some documents should also be maintained.

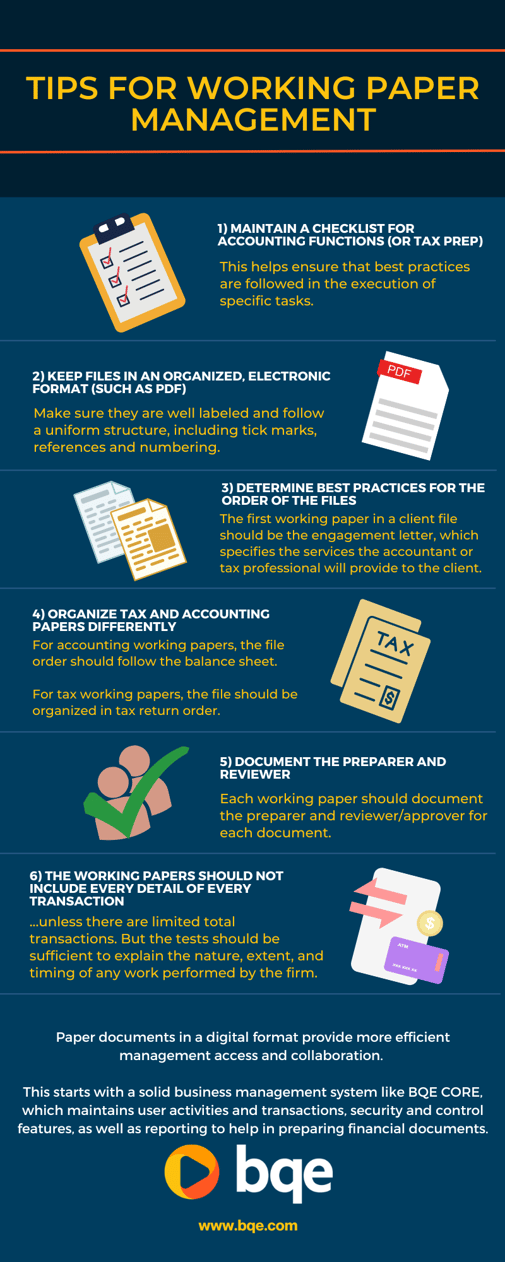

Maintain a checklist for accounting functions (or tax prep) that helps ensure that best practices are followed in the execution of specific tasks. This ensures processes are followed even in the event of staff changes.

Keep files in an organized, electronic format, such as PDF, that is well labeled and follows a uniform structure, including tick marks, references and numbering.

The firm should have best practices for the order of files. And the first working paper in a client file should be the engagement letter, which specifies the services the accountant or tax professional will provide to the client.

For accounting working papers, the file order should follow the balance sheet.

For tax working papers, the file should be organized in tax return order.

Each working paper should document the preparer and reviewer/approver for each document.

The significance, and impact of each working paper on the engagement should be evident.

The working papers should not include every detail of every transaction, unless there are limited total transactions. But the tests should be sufficient to explain the nature, extent, and timing of any work performed by the firm.

The most critical is missing documentation that is a CORE part of either tax return preparation or financial statement generation.

Problems can arise if working papers are not consistent with the firm’s work product, or where there are unexplained differences between what the working papers say and what the work product says.

There may also be problems if the working papers do not provide a reasonable basis for the firm’s conclusions based on established rules and precedent.

Missing checklists or review notes can also cause headaches when justifying conclusions.

Effective accounting software helps maintain controls on business operations, from financial issues to payroll.

This ranges from tracking all transactions, and requiring security protocols to access certain functions, to requiring additional two-person authorization processes and limiting overrides of system calculations.

Cloud accounting and business management systems also help identify irregularities when performing reconciliations and automate most financial postings, which greatly reduces the chances of human error or fraud.

Additional features include providing checklists of data the firm needs from the client, ensuring best practice organization of digital documentation, and providing client-ready presentations and financials with graphical elements that help explain financials to clients.

If you lose your working paper data, or input information incorrectly, this can be a major issue with the IRS. Managing bookkeeping, financials and taxes is already a stressful task, don’t make it any harder on yourself.

BQE CORE lets you seamlessly manage your firm’s operations, including your financial data, so you always have everything you need right where you can find it- correctly dated and secure. Never worry about keeping record again.

View key data in one place such as financial reports, profit & loss, balance sheets, trial balance, and GL. Always get the full view of financial performance at every level such as company, client, project, phase, and staff.

From project accounting, time and expense tracking, project management, reporting and analytics, and more, BQE CORE takes the stress out of managing your working papers and ensures you have everything you need to run a successful firm.

To learn more about BQE CORE’s project accounting feature, click here.

When you’re ready to try a free demo, we invite you to see just why our award-winning software is helping firms get more time back in their day and increase their project’s profitability.

BQE University is a hub of brilliant thought leaders in the architecture, engineering, and professional services industry. Each article offers a unique approach to education that emphasizes the importance of developing a business-thinking mindset for your firm. Their valuable knowledge and insights helps transform your business from a mere service provider to a thriving organization that consistently delivers projects that satisfy clients and generate profits. By learning from the experts at BQE, you can build a better firm and achieve your professional goals.

Good news: electronically filing your business taxes can take out much of the tax filing anxiety and streamline this process for your company.

Independent consultants take much more of the tax planning, management, and payment processes into their own hands.

Whether your business has 10 or 100 or more workers, you probably have a mix of employees and contractors helping your company grow.

Be the first to know the latest insights from experts in your industry to help you master project management and deliver projects that yield delighted clients and predictable profits.