Updated December 2024

As a firm leader you need accurate information about your business to make the best decisions. With so many tasks and responsibilities pulling you in many directions, time is a valuable but limited asset. Spending hours manually extracting data, copying and pasting it from one software to another in order to create the reports you need to manage your firm is not a good use of your time, nor your employees time. Especially if you have to repeat the process over and over again on a weekly or monthly cadence.

Compiling data across sources, crunching numbers, and creating reports this way is tedious and time-consuming and is costing you money. Especially when automated reporting tools are available to speed the entire process up and avoid human-error mistakes.

Manual reporting takes up so much time that it is one of the first things to get pushed aside when your firm is busy because there are other, more valuable ways to spend your time that actively grow your company. Yet this means you aren't getting an accurate picture of how your firm is performing on a regular basis, opening up opportunities for mistakes, errors, or unforeseen problems.

That’s why report generation is one of the most effective business areas to automate. When tracking and analyzing data related to your firm's profitability, earned value, and utilization, instead of manually gathering numbers and feeding them into Excel, try automated reporting technology like BQE CORE to automatically calculate key performance indicators (KPIs) and delvier them to the right people on a set schedule that you define.

Beyond saving yourself mindless work, report automation can also increase productivity and decrease costs. Meaning your firm can be more profitable.

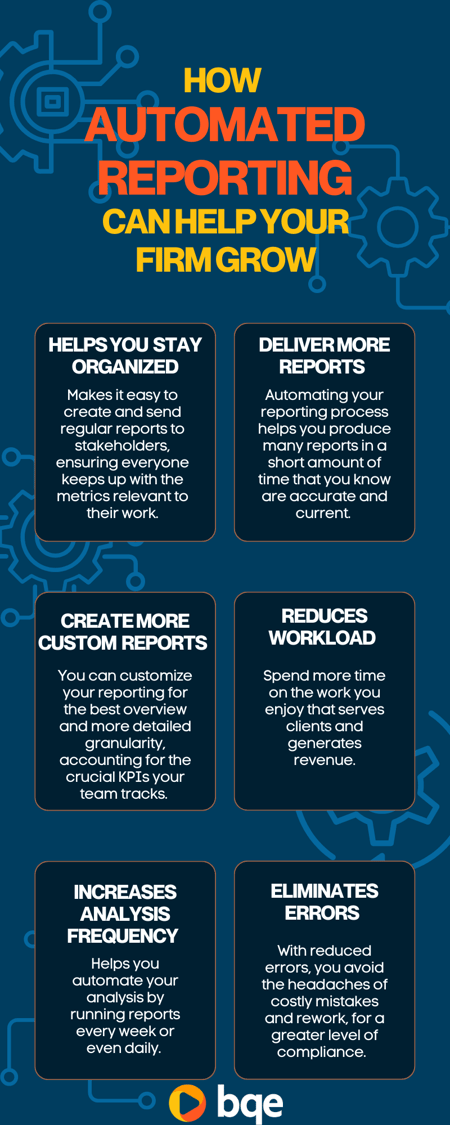

Automated Reporting Benefits

It Helps You Stay Organized

Reports must be done regularly and consistently to gather data that helps your firm improve its performance. But when you’re busy running a company, producing reports is often pushed aside for other time-sensitive and high-priority tasks.

Late reports can hurt relationships with your team, collaborators, and clients. It can affect their ability to finish their work and puts you in an uncomfortable position when someone repeatedly asks about a late report. Automated reporting solves this issue by making it easy to create and send regular reports to stakeholders, ensuring everyone keeps up with the metrics relevant to their work.

With manual reporting, your company has to rely on one person or team to provide updated data, but automating your reporting eliminates this. Once you set up your reports, they generate reliably, so clients and stakeholders know what to expect.

If you constantly feel yourself falling behind on generating reports, a tool like BQE CORE’s reporting automation is designed to create custom reports whenever you need them. The predictability and transparency you’re able to offer your clients and team creates trust and builds momentum.

Deliver More Reports in Less Time

Creating reports manually is time-consuming and slow but automating them allows you to generate more reports in less time. The faster you churn out reports, the more time you must analyze and use the data to make actionable improvements.

Automating your reporting process helps you produce many reports in a short amount of time that you know are accurate and current. With automation, you spend less time on report-creation tasks and more time focusing on data analysis and presentation. You also gain the freedom to concentrate on your clients' needs and manage your team toward success.

With BQE CORE reports, you can set up numerous custom reports that give you a detailed, holistic picture of your firm’s performance so you better understand the activities that drive revenue and the ones that hurt your project outcomes.

Create Custom Reports

Automated reporting allows your organization to gain deeper insights into specific performance areas. With BQE CORE, you can customize your reporting for the best overview and more detailed granularity, accounting for the crucial KPIs your team tracks.

Too much data is overwhelming, but smart reporting makes it easy to reduce data overload. Standard reports can be useful, but usually offer a mix of some data you can use and some you can’t. It takes time to parse and find what you need. Fortunately, you can build custom reports to your exact specifications, so you only get the information you need without spending hours digging for it and accidentally pulling incorrect figures.

Creating more custom reports helps you better understand how your team and projects perform. You gain a more in-depth understanding of how to execute projects within scope, budget, and without missing a deadline, ultimately saving you valuable time and money.

Reduces Workload

Spending too much time on repetitive, mundane tasks like data pulling and entry saps productivity and doesn’t make you feel fulfilled. It takes you away from the work you actually started your company to do.

If this is an issue for you, you’re not alone. More than 40% of us spend at least a quarter of the work week on manual, repetitive tasks like data collection and data entry. Automating your report generation reduces your workload so you spend more time on the work you enjoy that serves clients and generates revenue. By embracing automation, you set up your firm to be more innovative and profitable.

Increases Analysis Frequency

Tracking project data is basically meaningless if you don’t analyze it regularly. If you only review KPIs monthly or quarterly, it might be too late to fix something that has gone wrong, leading to wasted time, money, and opportunities.

.png?width=451&height=451&name=BQE%20CORE%20automated%20reporting%20(1).png)

BQE CORE helps you automate your analysis by running reports every week or even daily.

The BQE CORE dashboard makes it simple to review your project numbers based on contract amount and budget amount. At a glance, monitor your billed dollars, spent dollars, work in progress, and more for each project and phase so you can see how they’re performing.

If your project looks like it might go over schedule or exceed budget, you’re aware of it quickly and can respond.

BQE CORE's user-friendly dashboard presents information in an easy-to-digest way, so even with an abundance of data, your attention is directed to the most critical information. No more analysis paralysis.

Additionally, automated reporting can help you spot trends and patterns that might otherwise go unnoticed. When you spend less time on data entry, you have more time for analysis and strategy.

Eliminates Errors

Automated reporting reduces the chances of human error. When you manually create your reports in a program like Excel, you constantly have to worry about broken formulas and missing values. Excel doesn’t perform checks for accuracy, and one error in a spreadsheet can result in a completely inaccurate and unusable report. It’s difficult to update old reports in Excel, but building new ones is slow.

This improved accuracy is especially valuable for businesses that rely on data-driven decision-making. Producing a report quickly is important when you’re busy and trying to make a decision but are also worried about accuracy.

Automated reporting eliminates the manual errors that inevitably happen sometimes. With reduced errors, you avoid the headaches of costly mistakes and rework, for a greater level of compliance.

Grow Your Firm with BQE CORE’s Automated Reporting

You shouldn't have to spend hours each week manually extracting data to compile your firm's reports. Now, more than ever, you're looking for ways to cut down on time and money wasted. Automated reporting is one opportunity that also boosts performance for your firm.

With BQE CORE’s automated reporting, you can save time, improve accuracy, and enable consistency while keeping your company organized. Having reports generated automatically allows you to see changes and trends in your data as they happen. This can help you promptly make savvier business decisions that improve your bottom line.

Automated reporting is just one part of the powerful all-in-one BQE CORE platform, including back-office automation, project management, automated invoices, and streamlined time and expense tracking.

Get started with a free BQE CORE demo to see all of the features in action, including automatic reports, or keep reading the BQE blog for more tips on running your firm more efficiently and profitably.

Beyond Reporting

Automatic reporting is something all firms should be doing considering the access to software tools like BQE CORE and others. Yet this is only one area of your firm that benefits from setting up standard systems and processes. Mature firms are those that are strucutred and has SOPs for all areas of the business. Instead of being chaotic and putting out fires, the most profitable firms have built out processes for all areas of their business.

Running an engineering or architecture firm is a big responsibility and can be stressful. But it doesn't have to be. You can build a business that delivers great projects for your clients while being predictable and calm internally. This is something all firms should work towards and is the focus of the ebook below.

Download the Ebook:

7 Best Practices To Make Your Architecture Firm Less Chaotic