Updated 5/12/2023

When estimating project costs, it's crucial to consider all the expenses associated with employing staff members beyond their salaries. Neglecting to calculate labor burden can have a severe impact on your profitability, decreasing your chances of success exponentially. This means, understanding and accurately calculating labor burden is essential for effectively quoting potential clients and boosting your overall profitability.

Labor burden refers to the additional costs incurred above and beyond an employee's base salary or hourly rate. It encompasses various liabilities associated with employee expenses, including federal and state payroll taxes, local payroll taxes, job training taxes, workers' compensation mandated by the government, health insurance, retirement costs, and other factors that vary depending on the size of the firm and relevant regulations.

These costs may also include additional benefits such as flexible spending accounts, dental and vision care insurance, company vehicles, and more. To accurately determine an employee's bill rate and cost rate, it's crucial to have an accurate understanding of all these costs.

Calculating labor burden is vital for maintaining profitability. Without knowledge of the labor burden for each employee, it becomes challenging to accurately determine bill rates and cost rates, which directly impact your profit margins.

By accurately calculating labor burden, you can ensure that you are neither overcharging nor undercharging your clients, optimizing your chances for profitability. In the following sections, we’ll discuss the steps involved in calculating labor burden, enabling you to make informed decisions about your pricing and ultimately laying a solid foundation for your firm's success.

Calculate Labor Burden

Many firms simply don’t update their labor burden rate enough.

However, crunching the numbers to calculate your labor burden will help you effectively quote potential clients and boost your profitability.

But what exactly are we talking about?

Let’s get into the details.

What is Overhead?

Overhead refers to an expenditure that cannot be easily traced to a job or a division of the firm, unlike labor. Overhead costs do not directly generate revenue but are required to operate the firm. On the income statement, overhead refers to all costs except direct labor, direct materials, and direct expenses.

What is Labor Burden?

Labor burden is a type of overhead cost. Labor Burden refers to the actual costs above and beyond the employee’s base salary or hourly rate.

The burden includes liabilities associated with employee costs. Commonly required labor burden costs include:

-

Federal and state payroll taxes (Social Security, Medicare, unemployment)

-

Local payroll taxes

-

Job training taxes

-

Federal or state-mandated workers’ compensation

-

Health insurance

Other costs may be included in the labor burden. These vary by firm size, federal and state requirements, and other factors.

-

Retirement costs (pension, 401(k), other)

-

Flexible spending accounts

-

Health savings accounts

-

Dental insurance

-

Vision care insurance

-

Prescription drug programs

-

Company vehicle

-

Company mobile phone

-

Food and beverage offerings

-

Wellness activities

-

Training

-

Uniforms

-

Professional liability insurance

Talk to the professionals you trust to determine the costs to include in labor burden. Also, use an experienced person to calculate the labor burden for every employee – top to bottom in your firm.

Why is Labor Burden Important?

Profit, plain and simple.

Without knowing the labor burden for each billable employee (really, every employee), profit will be elusive. It’s like throwing a dart blindfolded after five pitchers of brew.

How do you determine an employee’s bill rate (and cost rate) with accuracy without knowing all the costs?

-

Benchmark Rate

The benchmark rate is based on hundreds of firms from across the country (maybe the world). Everything is the same for everyone, right? All firms have the same federal and state requirements, the same payroll taxes, the same cost of living . . . Your firm is just a mirror of the rest of the world, nothing is unique or special.

-

Joe’s Rate

You’ve been friends with Joe Doe for 20 years. You both started with the same firm out of college. You compete locally with Joe, and yes, your firm has had steady wins against him for a long time. Joe also does regional jobs, and his firm has grown steadily. Like any good friend, Joe shares information like a labor burden rate.

-

Shoot from the Hip

Draw on your experience. The most exceptional managers can follow this path to consistent profit.

So, if employee bill rates are good enough, what is the impact? It all starts with the proposals sent to clients and prospects using the employee bill rates.

Are you charging more than needed – overstated labor burden – to achieve your profit margin? Are you sucking profit margin – understated labor burden?

Bottom Line: Invest at least annually in labor burden calculations.

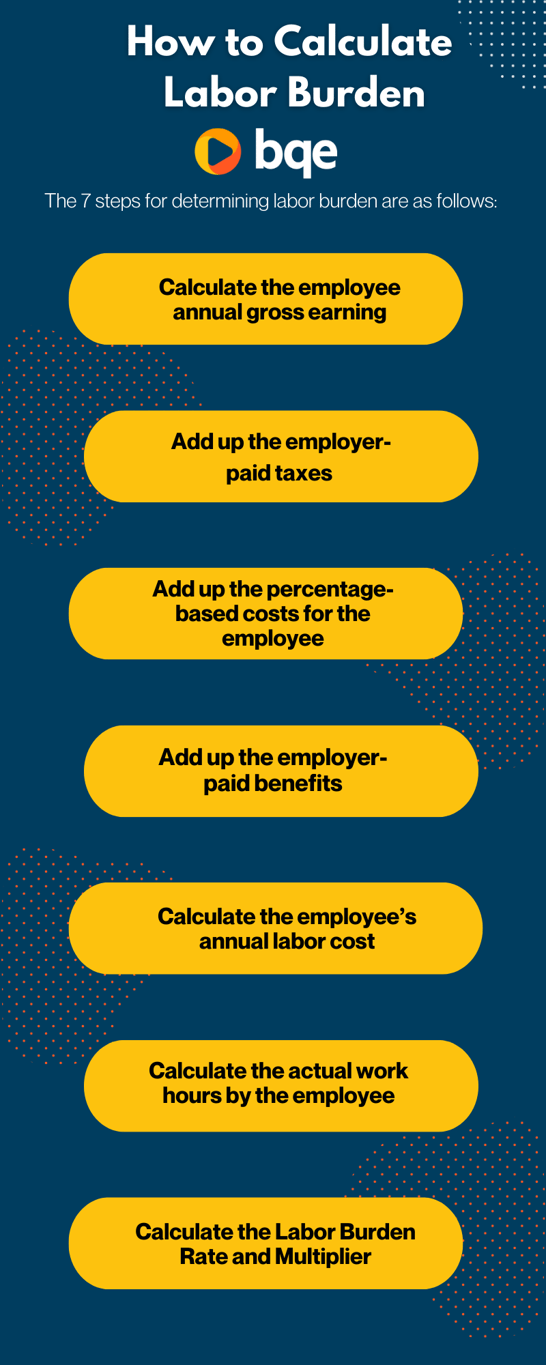

Calculate labor burden in 7 steps.

The 7 steps for determining the labor burden are as follows:

-

Calculate the employee annual gross earning.

For a salaried employee, this is the annual base pay before bonuses or other compensation. For an hourly employee, multiply the hourly rate times 2,080 (full time employee).

-

Add up the employer-paid taxes.

Typical taxes include FICA, FUTA, and SUTA. In some states and localities, local taxes and other items may be included in this calculation.

-

Add up the percentage-based costs for the employee.

Common costs include Workers Compensation, liability insurance, and 401K (company contribution portion).

-

Add up the employer-paid benefits.

These costs can be a short or extensive list depending on your firm’s competitive environment and owners’ employee retention plans. Common costs include health insurance, life insurance, meal reimbursement, company car, company mobile phone, and bonuses.

-

Calculate the employee’s annual labor cost.

Total 1. through 4. to compute the employee’s annual labor cost.

-

Calculate the actual work hours by the employee.

Actual Work Hours = Annual Paid Hours - Non-Production Hours

Be careful with this calculation. You need to calculate Actual Work Hours. This is NOT the same as paid hours. Actual Work Hours is the time spent by an employee working on a job.

First, add up the Annual Leave Hours.

-

Paid Vacation Hours

-

Sick Leave Hours

-

Company Holidays

Next, add up other types of non-production hours for the employee. For example:

-

Training (professional required, firm required, or option for the employee)

-

Non-project management activities

-

Company strategy and operations meetings

Now, compute the total Non-Production Hours by adding the annual leave hours and the other hours.

Finally, compute the employee’s Actual Work Hours by subtracting the Non-Production Hours from the Annual Paid Hours (typically, 2,080 hours).

-

Calculate the Labor Burden Rate and Multiplier

First, compute the Total Labor Burden Cost per Hour. Divide the employee’s annual labor (5. above) by the actual work hours (6. above).

Next, determine the employer portion of the labor burden cost per hour. Subtract the total labor burden cost per hour from the employee’s hourly pay rate (1. above).

Finally, to compute the Labor Burden Rate (percentage), divide the employer portion of the labor burden cost per hour by the employee’s hourly pay rate. To convert it to a multiplier, add 1 to the percentage.

Labor Burden is a Foundation for Your Firm

As mentioned above, labor burden is part of a firm’s overhead. The additional elements relate to the costs of operating your firm that do not directly generate revenue. Rent, telephone charges, utilities, office supplies, maintenance, business insurance, and similar items are common overhead examples. Without them, your firm would likely not exist. You would not have the foundation for delivering your professional services. Overhead is a burden on the overall firm.

To learn more about labor burden and other tips on managing your firm, visit BQE Software’s blog for the latest updates in professional services.

Want more tips to increase efficiency and improve your bottom line? Click below to download a free eBook on key financial metrics to measure your project performance.

See how CORE can help your firm

Request a free live demo to get questions answered by our experts.