If your time tracking and billing software has the ability to run financial reports, like the profit and loss statement, then you'll want to put great care into how that financial report is presented.

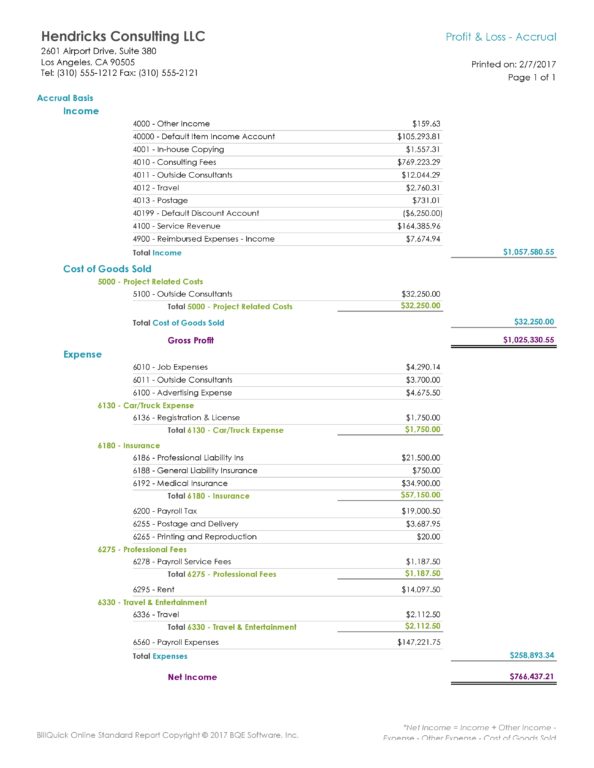

If you look at my sample Profit and Loss Statement from BillQuick Online, you will see a nicely presented financial report. It's critical to me, that I can get this kind of information out of my time tracking and billing software, so that I can manage everything from one place. The reason I say this is a well formatted report, is that it's very easy to read. I can see all of my insurance costs, nicely laid out, in the insurance section. This is accomplished by grouping a set of sub-accounts underneath the parent account.

One really important thing, is that when you establish accounts with sub-accounts, you never want to post any transactions to the parent. Everything must go to a sub. It's clean that way.

There are guidelines for financial presentation, but no hard line, right and wrong about how to do it. There are some common struggles with how to present things on the P&L. Hopefully your time tracking and billing software, and / or your accounting software makes it easy to move things around. What if, for example, you wanted to have "Automobile" expenses in a section. Then the question arises. Do we put the Auto insurance there, or do we leave it in Insurance?

Which way to go really depends on how you want to read about it on your profit and loss statement. Are the auto expenses significant for your company? If so, then it might make sense to have the Auto section, and move the Auto Insurance there. If you choose to go that route, then you might want to re-name, or re-purpose the insurance section.

One thing I would definitely change on these books, is that "Payroll Taxes" should part of Payroll expenses. Payroll taxes belong under payroll expenses, along with Salaries. Also if you're an S-Corp, you should separate Officer's Salaries. Then, depending on your business, Payroll can get infinitely more complicated than that. I also prefer to put the payroll fees under Payroll expenses. Professional fees are something I reserve for things like Accounting and legal fees.