BQE University

When most attorneys hear the phrase “profit margins,” they either draw a blank or they tell me what they think it means. Nine times out of ten, they don’t really understand what it means. Therefore, they aren’t leveraging the power behind knowing their margins. So let’s clear it up.

What Are Profit Margins and How Do You Calculate Them?

Simply put, your profit margins are your gross revenues minus the direct expenses required to generate that revenue. I’m not talking about an income statement here. Your income statement shows revenue minus all expenses, leaving you with your taxable profit (bottom line). We want to know how much it costs you to generate X amount of revenue with the minimum required cash outlay.

Profit Margin Calculation Example

Here’s a simple example.

Matter A generated $6,000 in revenue. From the time the matter was created to the time it was completed and closed out, the firm incurred $671 in staff wages and $250 in filling and other fees. It’s important to note that the wages reflect only the time each staff member put into this case. This yields a total profit margin of $5,079 or 84.65%.

Notice that expenses like office supplies, rent, internet, and meals are not included. These are not direct expenses that are necessary to generate revenue; these are called overhead expenses and are not included in your marginal calculation.

Top 3 Mistakes to Avoid When Calculating Profit Margin

Now, before you go crunching numbers, you should know the top three mistakes attorneys make when trying to uncover their profit margins.

Mistake #1 – Not separating matter types

Mistake #2 - Not accounting for all the costs

Mistake #3 – Not exploring ways to cut costs

The Importance of Separating Matter Types

I was on the phone with a prospect, we’ll call her Sharon, discussing profit margins. Sharon had been running a family law practice for six years by the time she reached out to us. Her practice areas included divorce, adoption, custody, restraining order, visitation, and a few one-off legal services within family law.

I started to talk about profit margins and why they matter when she stopped me mid-sentence to say, “Oh, I already know that divorce cases make up 80% of my practice so that’s where we focus.” So, I kindly asked her, “Which type of divorce yields your highest margin?” “What do you mean?” she asked.

Way too often, attorneys go with the numbers that reside in their heads (often those are not accurate). They also assume that because a practice area contributes, let’s say, 80% to their top line, it also contributes 80% to the bottom line (profit). Surprise! That’s not at all the case.

Sharon decided to sign on the dotted line and became our client. Once we ran her profit margins, she was astonished to find that her divorce cases, while contributing 80% to her top line, only accounted for 65% of her bottom line profit. Why? I’ll share with you in a bit, but it boils down to her not knowing which matter type was dragging the profit margins down. Something she would have never realized had she not seen the numbers in black and white after separating her practice area into specific matter types.

It’s not enough to look at your P&L and take revenue: wages and fees. Here’s the golden nugget. The first step to calculating your profit margins is to break your revenue out into matter types. Here’s what Sharon’s looked like:

Uncontested Divorce

-

No property

-

Complex

-

Simple

-

Mediation

-

Temp. order with kids

-

Temp. order no kids

-

Property written discovery

-

PWD motion

-

Respond to written discovery

-

RWD motion

-

Taking disposition

-

Defending disposition

-

Expert witness

-

Trial

Contested Divorce

Instead of looking at the practice area of divorce, as a whole, we split it into the possible “a la cart” scenarios that could happen. By doing this, we were able to see that under her current pricing, the simplest type of divorce with no property was the one with the lowest profit margin. Unfortunately, this matter type accounted for almost half of her divorce revenue, so it was dragging down the bottom line.

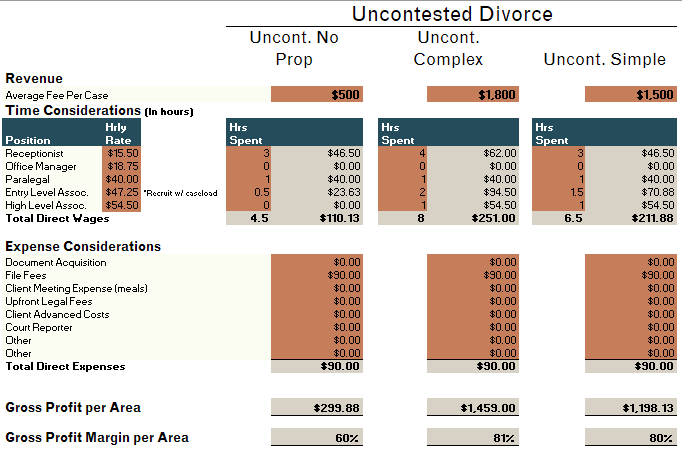

Once she could clearly see the numbers, Sharon recognized that her uncontested no property matters were yielding a much lower profit margin than the other uncontested divorce matter types. This is why 80% of uncontested divorce revenue only contributed 65% to her bottom-line profit. Knowledge is power, and when you know better, you can do better.

How to Account for All the Costs

Often, we think too much about the numbers and forget about the time component. Your cost per case doesn’t begin once you start working on a case; it begins when the receptionist answers the phone the first time they call to inquire about retaining your services and even before that (if you’re following your marketing metrics and conversion costs). It’s not just your billable hours; it’s the hours for all involved staff and the fees directly tied to the matter.

As Sharon and I were going through our analysis, she kept trying to calculate only the hours for which a billable hour fee model would consider. We came to the receptionist line item and I asked her “How much time do you think your receptionist would spend on one uncontested divorce with no assets?” She responded, “Oh, no time on her end. She doesn’t do any of the actual case work.” I then asked, “Does she speak to the client over the phone throughout the case duration?” “Well, yes,” she responded.

We found three whole hours from prospect intake to case completion where the receptionist spent time. She would ask questions to gather basic information before the consult, ask any remaining questions once the client agreed to engage in their services, update the client during the case, and provide closing information once the case was completed. That right there matters folks. Administrative and customer service tasks take time, and time is money.

Explore Ways to Cut Costs

You and I are cut from the same cloth in a lot of ways. I come from the tax and accounting industry and you’re in the legal industry. Both industries deal with government agencies who are notoriously slow to adapt, slow to change, and avoid technology (until recently thanks to COVID thrusting us both into the 21st century). We sometimes take on the mindset and habits of the entities we so often deal with.

Working remotely and with remote staff is possible, COVID has proven that to us. On the flip side, I deal with many lawyers who have Shiny Object Syndrome when it comes to technology. They just keep throwing money at it without ever actually using it to its fullest potential (then they forget they signed up for it and keep paying that monthly fee until someone like me notices).

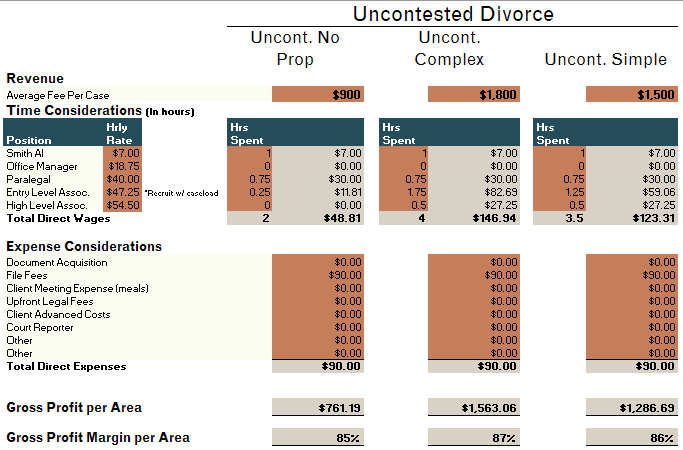

Sharon discovered, after we found the imbalance, that she had hired a 40-hour-per-week receptionist for a 10-hour-per-week job. So, what did she do? She outsourced the incoming calls and automated her pre-consult intake process with an online intake form. Ba-da-bing! One full-time position eliminated for a per-call fee model. She also realized that her fees for uncontested no property cases weren’t in line with the fees for other uncontested matter types, so she increased it to account for marginal differences. Here’s the difference her actions made:

By looking at the matter types within her practice area of divorce, she was able to clearly see what her options were for maximizing profits while maintaining a top-notch client experience. And she took action to correct the imbalance. She has since collected feedback from clients that her new processes were remarkably simple yet thorough (aka value-added).

Adjusting your systems and processes are the only way you’re going to scale while protecting profits at the same time. Don’t fall into the trap of thinking you have to spend a butt-load of money before you can make more money. Look for efficiencies in technology and in your workflows.

Know Your Profit Margins and Change the Game

Whether you’re a solo attorney or you run a multi-location firm with 50 attorneys, knowing your margins is a game-changer. Don’t convince yourself this stuff doesn’t matter. When you opened your doors, you likely had financial goals that would allow you to retire comfortably or work by choice instead of obligation. You cannot manage what you cannot see. Invest in yourself and in your firm’s success by getting financial clarity around your services.

Knowing your margins not only allows you to build a financial foundation, but it also opens the doors for financial foresight. What do I mean by that? When you have unlocked your revenue formulas, you have also unlocked the ability to see and project your firm’s financial future. Marketing strategies can be targeted to bring in a specific matter type, you can see at what point you’ll need to hire someone else to handle an increase in workload, and many other things that you would have otherwise been blind to.

Knowing your profit margins is powerful. Do you know yours?

Did you enjoy the blog? Let us know by leaving us your feedback in the Comments section at the bottom of the page.