Mike Webber, a veteran practice executive, details why your biggest cost—and your biggest payoff—is your staff.

The one element that is central to all financial talk at an architecture or engineering firm is the importance--and cost--of people. The salaries and other payroll expenses of people constitute up to 75% or more of a firm’s total operating expenses.

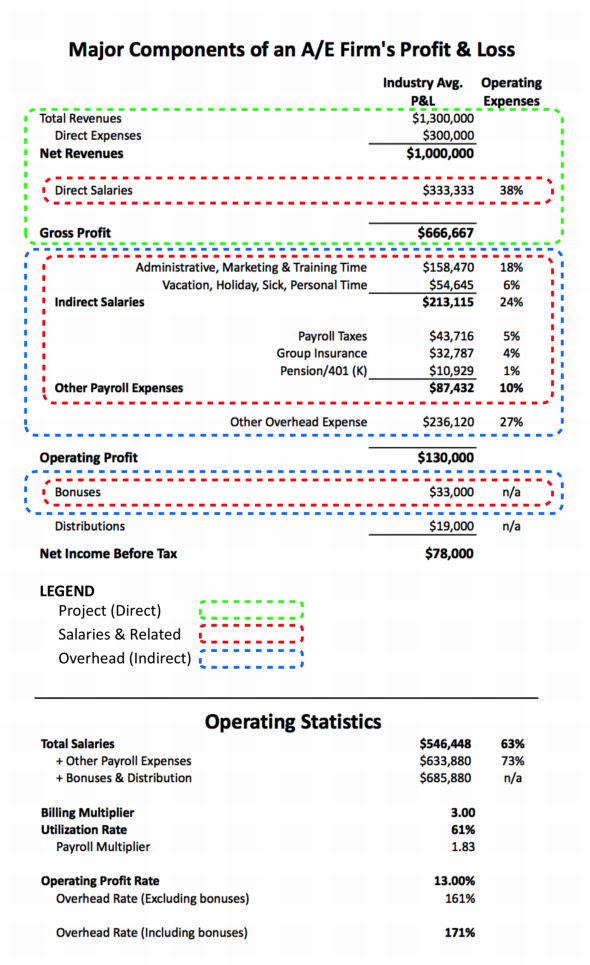

Don’t believe it? Below is a simplified but straightforward and standard A/E profit and loss statement. The numbers are a scalable compilation of industry-average information from various sources--averages that haven’t changed that much over many years.

In this example, the firm has $1,000,000 of net revenue and operating profit of $130,000, which results from a more-or-less industry average operating profit rate of 13%, a 3.00 billing (net) multiplier, and a 61% utilization rate.

Note that I am starting by emphasizing net revenues. Net revenues are total revenues minus all direct expenses. Direct expenses do not just include consultants but also such project expenses as travel, printing, etc. – all other expenses incurred, specifically for a project, regardless of whether they are reimbursed or not. The point is the $300,000 amount shown here goes to someone else. They are not part of your firm’s expenses. Net revenues are what are left for your firm.

With $1 million in net revenues and $130,000 of operating profits, this example has $870,000 of operating expenses. Operating expenses are the amount of money you spend on your people and for your overhead. And if your operating expenses are less that your net revenues, then congratulations. You've made a profit!

Now, let’s look at what makes up those operating expenses – and here is where the “people costs” become emphasized. Of the $870,000 of operating expenses, almost $550,000, or 63%, of operating expenses is just for direct & indirect salaries. Add another $87,000-plus for other payroll expenses – payroll taxes, workers comp, health and life insurance and pension/401(k) contributions – and the total is up to $630,000, or 73% of your operating expenses. That doesn't even include bonuses or distributions, which are ‘below the line’ (after operating profit) expenses!

All of a firm’s other expenses – rent, utilities, E&O insurance, office supplies, even all the computers and software, and everything else we use in our practices today – individually pale in comparison to total salaries and other payroll expenses. Are they important? Of course they are! It’s still 27% of costs, and all expenses need to be reviewed and spent prudently. However, the cost of major things like health insurance, rent, E&O insurance and such are negotiated maybe just once a year. Payroll taxes can’t even be negotiated. After that, what’s to manage?

But that’s not the point of this article – and yet it is. The most important cost to any firm, but the one that also happens to produce all its revenues, is people. This should be no surprise. We are in the people business. It is the hours and talents of our people that we use to design and engineer our projects. As such, the primary job of any manager – at any level of any firm – is to efficiently and effectively manage and utilize people to accomplish projects at least up to the quality standards of the firm and the client...Oh, and you need to make a profit too or, before long, you may not have a firm to manage.

But to do all this, you must have the right mixture of the right people with the right training, technology and staff support, and motivation. They must have the skill sets and experience necessary for the types of projects and clients the firm has, or wants to pursue. There needs to be the optimal balance of intern, intermediate, and senior people, along with mentors, leaders, and marketers. There should be the cultural “fit” so necessary for success yet so nebulous to define. And, yes, it also needs to be multi-generational, with a succession plan to bring in and develop the leaders and owners of the future.

Each of these points requires a column of their own. My sole point here is that any preoccupation with overhead is not consistent with where revenues and profits are derived. With 75% of operating expenses being people-related, 75% of your focus needs to be on developing them and on completing projects.

Just as so many firms acclaim, people really are our most important asset. Your job is the efficient and effective management and support of them: efficient project management, maximizing net multipliers and effective use of people, thus optimizing utilization.

About the Author

Mike Webber started A/E Finance after years as a CFO. He works with A/E Principals and Boards on operations, financial analysis and systems; strategic planning, turnarounds and interim assignments. His professional involvements include Chair of AIA Chicago's Practice Management KC, AIA/ACEC Peer Reviewer, ACEC's Management Practices Committee, and AIA’s Best Practices Review Committee member and author. He can be reached at mawebber@aefinance.net.