How to Manage Project Workflow in QuickBooks

How to Manage Project Workflow in QuickBooks - BQE Software

Setting up QuickBooks for architects and engineers can be quite simple when you know the essential steps required.

Updated 4/25/2023

QuickBooks Online integrates seamlessly with BQE CORE, the award-winning firm management software built for professional services firms. BQE CORE offers business intelligence, project management, time and expense tracking, billing, accounting, and reporting together in one intuitive package. You can integrate BQE CORE with QuickBooks or handle your accounting within BQE CORE so it's right alongside all your other essential business processes.

As an architect or engineer, managing your finances can be a tedious and stressful task. Keeping track of expenses, managing invoices, and ensuring that your books are up to date can be time-consuming and often, unfortunately, error-prone. That's where QuickBooks for architects comes in.

In this article, we’ll discuss how to set up QuickBooks for architects and engineers, so you can streamline your financial management and focus on what you do best - designing and building.

QuickBooks for Architects and Engineers

There’s a reason QuickBooks is so widely used in the A/E industry.

QuickBooks is a powerful accounting software that can really help architects and engineers, like yourself, manage your finances quickly and efficiently. And we all know how much we hate managing finances.

However, when you use QuickBooks, you can quickly and easily create invoices, track expenses, manage payroll, and generate financial reports.

The software can save you time and money by automating routine tasks and ensuring that your financial records are accurate and up to date which is a huge win and one of the reasons it’s so popular.

QuickBooks is also often used because it’s an ideal solution for small to medium-sized architecture firms that need an easy-to-use accounting system that can grow with their business.

However, knowing how to get started may seem like a tricky task. Let’s take a look and see just how easy it can be working in QuickBooks.

Trying to find the right project management platform that easily integrates with all of the data you currently have in QuickBooks? BQE CORE 's award-winning project management and billing software for architects and engineers provides better collaboration and faster success than if you're using QuickBooks alone or with multiple point solution software.

See how we integrate seamlessly with QuickBooks and help you manage everything from one dashboard.

How to Set Up QuickBooks for Architects and Engineers

First things first. Before setting up QuickBooks, it's important to identify your business requirements and goals. This might not sound like something you would need to set up QuickBooks but knowing your goals and requirements will help you determine which features and functionalities you need from the software.

This makes the set up much easier.

For example, do you need to manage payroll, track time and expenses, or generate financial reports? Identifying your business requirements and goals will ensure that you choose the right version of QuickBooks and set it up to meet your specific needs.

There are many industries that require special attention when setting up QuickBooks. Architects and engineers are right at the top of that list. The A/E industry is a very specialized industry with its own preset setup available in the QuickBooks setup interview.

The choice you are looking for during the initial setup is under industry and it’s called “Architects / Design / Engineers.”

QuickBooks Chart of Accounts

Creating a chart of accounts is an important step in preparing for QuickBooks setup and one of the earlier steps you’ll encounter.

A chart of accounts is a list of all the accounts and categories that you’ll use to track your financial transactions in QuickBooks. This will include your bank accounts, credit cards, income and expense categories, and other financial data.

Creating a chart of accounts will help you organize your financial information and ensure that your books are accurate and up-to-date.

Setting up your item list and your chart of accounts

Of course, if you ask three different architects or engineers, you’ll get three different variations on similar themes as far as how to set up your item list and your chart of accounts.

These two lists are at the core of your accounting system so careful attention is required here. It’s helpful to know how you want this set up from the beginning.

As far as the chart of accounts goes, it’s not a bad idea to leave this bare and add what you need as you need it, especially since QuickBooks makes it easy to add accounts when/as you need them.

This can be good and bad.

Our advice is to avoid creating many accounts. We prefer a nice, simple chart of accounts. If you want the details of an expense account, you can double click from the P&L and total by payee to see a very clear picture of exactly what is in there.

The item list takes a little more thinking. How do you want to use this list?

This is the list of “activities” that you’re going to bill your client for. If you sold products these would be the products that you sell. As a service-based business, you have to think about what best describes what you’re selling. How do you want to set this up?

The AIA Guide has you using the “Phases” as the item list. These are very unique to the architecture industry and refer to the phases that a single project goes through:

10 Programming / Feasibility

20 Existing Construction Review

30 Schematics/Planning

40 Design Development

50 Contract Documents

60 Bid/Permit

70 Contract Administration

80 Additional Service

90 Unbillable Time

95 Reimbursed Expenses

Our preference is to bill based on people’s time.

So, we like to set up items based on who is doing the work, because that drives the rate we’re going to bill.

For example, you might bill $85/hour for a designer, but $150/hour for a project manager.

So, your list might look something like this:

Staff Architect

Design/Drafting

Associate

Clerical

Construction Administrator

Expert Witness (hey it happens!)

Project Designer

Project Manager

Identifying and organizing financial data

Identifying and organizing financial data is another important step in preparing for QuickBooks setup.

To do this, you’ll need to gather and organize all of your financial data, including bank statements, receipts, and invoices.

Your financial data will need to be entered into QuickBooks so that your books are accurate and up to date. This doesn’t have to be done manually. When you integrate QuickBooks with all-in-one firm management software, you can pull your data quickly and easily.

Organizing your financial data before setting up QuickBooks saves you time and helps you make sure that your data is accurate.

Choosing the right version of QuickBooks

Did you know there are many versions of QuickBooks?

That’s right.

So, having the right version for your firm is also important when preparing for QuickBooks setup.

There are several different versions of QuickBooks, including QuickBooks Online and QuickBooks Desktop.

Each version has its own features and functionalities, so choosing the right version will depend on your specific business needs.

QuickBooks Online is ideal for businesses that need to access their financial data from anywhere, while QuickBooks Desktop is ideal for businesses that need more advanced features and functionalities.

Setting up QuickBooks for Architects and Engineers

Creating a new company file is the first step in setting up QuickBooks.

This involves entering your company information, such as:

company name

address

contact information

Once you've created a new company file, you can start setting up the various components of QuickBooks.

Customize company settings

Next you want to customize your company settings.

This will involve setting up your:

fiscal year

selecting your accounting method

choosing your tax form

Customizing the company settings is important because it makes sure that QuickBooks is set up to meet your specific business needs.

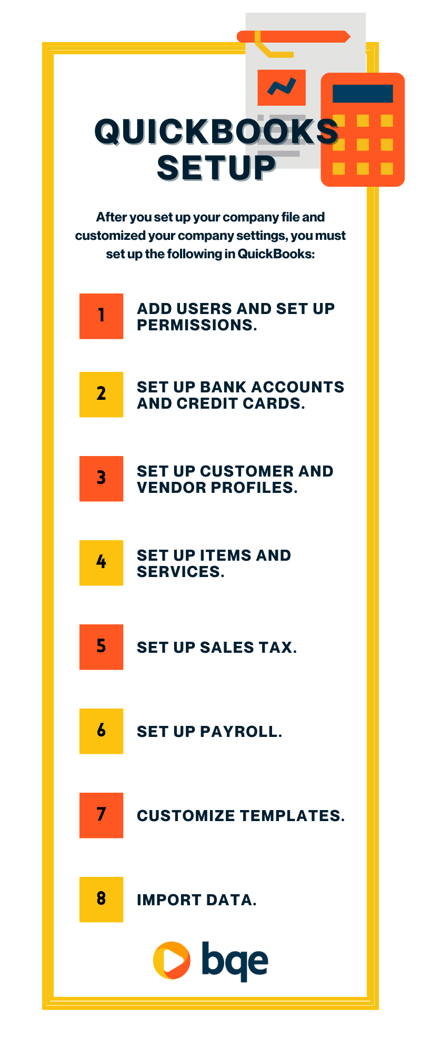

Once you have the first two steps ready to go, you’ll want to follow with these basic QuickBooks set up steps:

Add users and set up permissions. You can add users with different levels of access and set permissions for each user. Adding these permissions makes sure your financial data is secure and only accessible to those who need it.

Set up bank accounts and credit cards. You’ll need to enter your bank account and credit card information into QuickBooks so that your financial data is accurate and up to date.

Set up customer and vendor profiles. This involves entering customer and vendor contact information, such as their names, addresses, and phone numbers. You can also set up payment terms and credit limits for your customers and vendors.

Set up items and services. Here you’ll create a list of all the items and services that your business provides. You can also set up prices and descriptions for each item or service.

Set up sales tax. You want to set up tax rates for each state or province where you do business. QuickBooks will automatically calculate sales tax for each transaction based on the tax rates you've set up.

Set up payroll. Next you want to enter employee information, such as their names, addresses, and social security numbers. You can also set up payroll schedules and tax information for each employee.

Customize templates. During set up, you want to customize invoices, estimates, and other forms to include your business logo and other branding elements. Customizing templates is vital so that your business looks professional and consistent.

Import data. The final step in setting up QuickBooks for architects and engineers will involve importing financial data from other software programs or spreadsheets. QuickBooks makes it easy to import data, which will save you time and have your financial records accurate and up to date.

Using QuickBooks for Architects and Engineers

Create estimates and proposals

This is a crucial step in the A/E industry. With QuickBooks, you can easily create and customize estimates and proposals for your clients. QuickBooks makes it easy to track your estimates and proposals, so you can ensure that you are meeting your clients' needs and staying within your budget.

Manage project budgets

Management is crucial for architects and engineers who need to stay within their clients' budgets. QuickBooks makes it easy to track your project budgets, so you can ensure that you are staying on track and meeting your clients' needs. You can also generate reports that show how much money you've spent on each project, so you can easily see where your money is going.

Generate financial reports

Some of these reports include profit and loss statements, balance sheets, and cash flow statements. These reports can help you make informed decisions about your business and identify areas where you can improve your financial management.

Reconcile bank and credit card accounts

Reconciling your bank and credit card accounts through QuickBooks helps you ensure that all of your financial transactions are recorded correctly. This also helps you identify any errors or discrepancies in your financial records and ensure that your books are accurate and up to date.

Tips and Best Practices Using QuickBooks for Architects and Engineers

Backing up data regularly is a crucial best practice for any business that uses QuickBooks. QuickBooks makes it easy to back up your data to the cloud, so you can ensure that your financial data is secure and easily accessible.

Regularly backing up your data means that you never lose important financial information and can quickly recover from any data loss or corruption. If you have all of your data stored in your computer, if something happens, you can lose everything. Even worse if you have information filled out in a spreadsheet. Spreadsheets are notorious for self-deleting and losing your important information.

Another important practice when using QuickBooks is to maintain accurate and up-to-date financial records. You should ensure that all of your financial data is entered correctly and on time, so you can generate accurate financial reports and make informed decisions about your business.

Regularly reviewing and reconciling your financial records will help you identify any errors or discrepancies and ensure that your books are accurate and up to date.

Automate routine tasks is an excellent way to save time and improve your productivity when using QuickBooks. QuickBooks makes it easy to automate routine tasks such as invoicing, payroll, and expense tracking. Automating these tasks will help you stay organized and focused on more critical business activities, such as project management and client relations.

With extra automation and ease of use, consider integrating QuickBooks with other software tools to streamline your business processes.

QuickBooks, while very helpful, can be tricky to use on its own.

When you integrate it with an all-in-one dashboard like BQE CORE that manages your accounting, invoicing, project management, reporting, time tracking, and more, you get to use QuickBooks easily through your own platform without having to switch back and forth in between QuickBooks and your other software and deal with data transfer and possible errors.

Everything, including QuickBooks, is in one place with BQE CORE.

Integrating BQE CORE with QuickBooks will help you keep all of your business data in one place, improve your workflow, and reduce errors.

BQE CORE + QuickBooks for Architects and Engineers

QuickBooks is an essential tool for architects and engineers who want to streamline their financial management processes and stay organized. With QuickBooks, you can easily create invoices, track expenses, manage payroll, and generate financial reports.

QuickBooks is a powerful software tool that can help architects and engineers save time and money and improve their productivity.

If you're an architect or engineer looking to set up QuickBooks, we encourage you to get started today, and combine your QuickBooks with smart all-in-one firm management software like BQE CORE.

QuickBooks easily integrates with BQE CORE so all of your data is in one place, meaning you have one tool to manage accounting, billing and invoicing, project management, time and expense tracking, reporting and analytics, HR, and more.

With BQE CORE and QuickBooks, you can focus on what you do best - designing and building - while leaving the management to the experts.

Try a free demo of BQE CORE today.

Manage Your Entire Business in One Place with

BQE CORE

BQE University is a hub of brilliant thought leaders in the architecture, engineering, and professional services industry. Each article offers a unique approach to education that emphasizes the importance of developing a business-thinking mindset for your firm. Their valuable knowledge and insights helps transform your business from a mere service provider to a thriving organization that consistently delivers projects that satisfy clients and generate profits. By learning from the experts at BQE, you can build a better firm and achieve your professional goals.

How to Manage Project Workflow in QuickBooks - BQE Software

QuickBooks For Architects - Setting up Your Workflow - BQE Software

QuickBooks for Engineers - Entering Costs So They Can be Tracked by Item - BQE Software

Be the first to know the latest insights from experts in your industry to help you master project management and deliver projects that yield delighted clients and predictable profits.